High streets have always been the go-to place for retail expansion. It has always been the proverbial promised land of retail. A microcosm of the global retail industry, high streets are where brands from foreign shores rub shoulders with homegrown brands.

But the retail apocalypse raging worldwide that escalated due to the pandemic has now drawn a question mark on the sensibility of opening a retail store on the high street.

As per recent news, Khan Market has reached the list of the most expensive high streets globally. From the exorbitant rentals to the added operational costs such as employee salaries and training, we uncover the financial maze that might leave your business in shambles if it is not the right place for you.

Considering the diverse demands of today’s consumers, a one-size-fits-all approach won’t make the cut.

Moreover, differentiation becomes critical while stepping into the competitive jungle surrounding high streets. In this article, we dissect the pitfalls of relying on gut instincts over data-driven decisions, showcasing how RetailIQ’s machine-learning models offer a street-level understanding of your next store location.

Rethink the conventional wisdom that high streets are the pinnacle of retail success. Sky-high rents, omnichannel retail demands, inflation, and fierce competition have reshaped the retail landscape.

Learn how leveraging data-backed solutions can help you identify profitable locations and navigate the intricate dance of retail expansion.

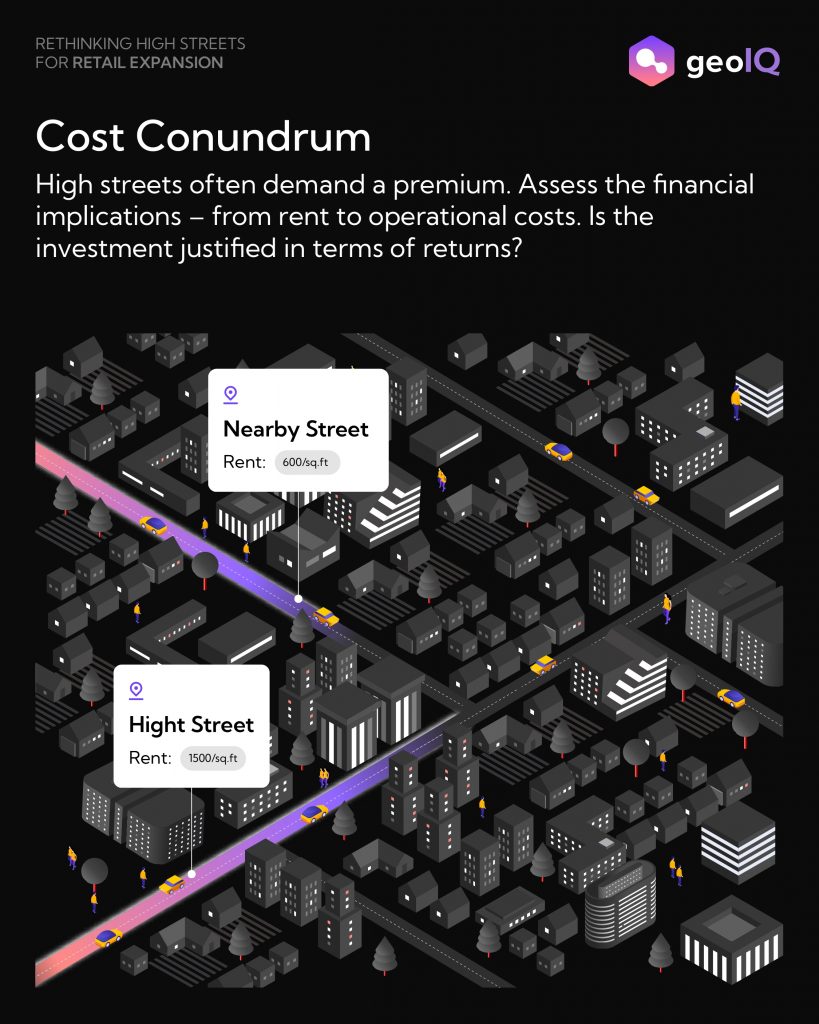

Cost Conundrum of High Street

As mentioned earlier, Khan Market in Delhi recently became one of the most expensive high streets in the world.

But with this elevated status comes a not-so-enviable rental rate of ₹1,000-₹1,500/sq. ft. every month. Compare this against the rental rates at malls in Delhi, falling between ₹125 sq. ft. to ₹600 sq. ft.

Factoring in the cost of employee salary and the inventory cost will generate an expensive monthly bill. Stores on the high streets also require an additional investment in training staff to provide a seamless retail experience. The average manager at a high street boutique earns between ₹26,000 and ₹45,000 monthly.

The average retail store size in India is 1,180 sq. ft., and on a high street where space is a premium, the size of a retail store will increase the capital expenditure.

Defining the Spending Quotient of your target customer and understanding the catchment area of your target audience will help you narrow down your choices of potential locations. You can then employ GeoIQ’s models trained using real-world data to draw inferences about your selected location.

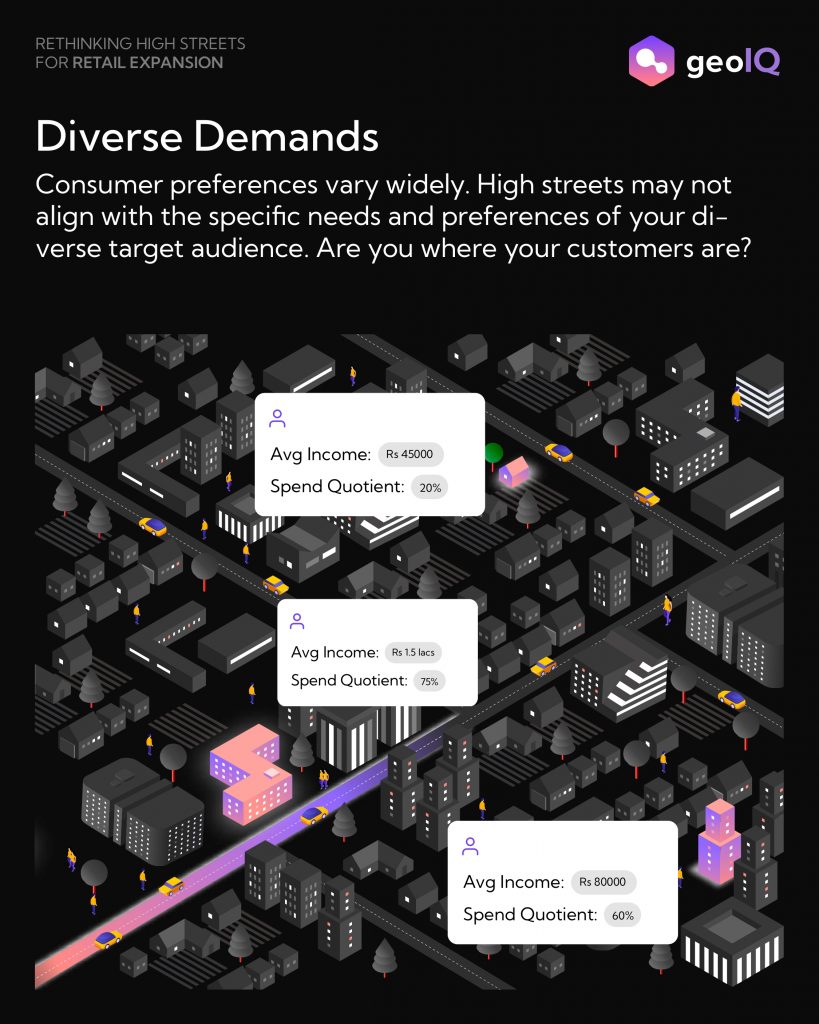

Diverse Demands Not Met by High Street

Consumer preferences are not one-size-fits-all. High streets may not align with a diverse target audience’s specific needs and preferences. Retailers must ask whether they are truly where their customers are. Understanding and catering to the unique demands of the customer base is pivotal for success.

People living in Old Chennai will attest to the gravitational pull of T. Nagar during the holidays. This high street has retail stores dedicated to fast fashion and jewelry categories. Now, consider that you are placing your store in the eye-wear category in this location. Will this store location help you attract your target audience?

The store might be in an area with high foot traffic, but it cannot convert these customers as they are not the target audience.

Opening a retail store on a high street and hoping that the foot traffic will convert to an increase in sales might generate lower revenue than anticipated. One way to mitigate this loss in revenue is to analyze the secondary catchment market for your brand and build stores close to the high street.

According to this Deloitte report, the current generation of millennials and the upcoming cohort of GenZ retailer shoppers demand diversification in their retail needs. This is due to the changing cultural landscape of the cities and fueled by the growth of a generation that grew up on the internet and had the perspicacity to discern the advantages and disadvantages of the various product offerings in the market.

This is similar to the Indian scenario where Gen Y (48%) and Gen Z (39%) reported that they cannot imagine an existence without the internet. With 98% of all GenZers in India shopping in-store, retailers must leverage technological advances to meet this generation’s diverse demands.

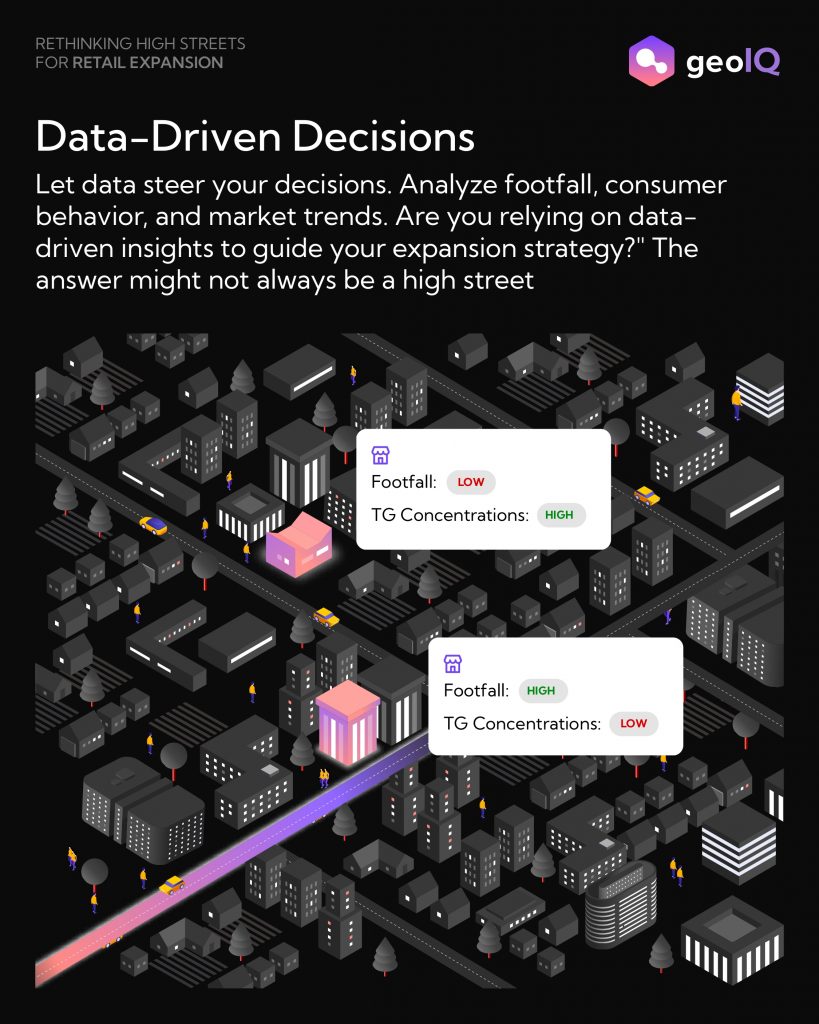

Data-Driven Decisions

In an era dominated by data, decisions should be guided by insights. Retailers must delve into the intricacies of footfall, consumer behavior, and market trends. Relying on data-driven insights is crucial in shaping a successful expansion strategy, and sometimes, the data might lead to something other than the high street.

Retailers have always relied on their gut instincts to expand and build new stores. The folly with this approach is that due to the fortuitous success created in the past, they believe in the probability of generating another accurate solution.

With data, these retailers can now build a pragmatic overview of the locations where they can find their target audience. But the big question is, what data should be used? And is it available in consumable form? The answer is to employ alternative forms of data like location data to identify locations that can improve their revenue. But again, getting this data in a directly consumable form is a more significant challenge.

Granular Insights for Street-Level Retail Success

GeoIQ helps solve for the availability of location data and the clarity in understanding this given data. Our ML models leverage location data to support business expansion heads in developing a granular street-level understanding of their site location.

GeoIQ’s machine learning models utilize the data collected from various government agencies and other public data sources to help a business expansion head of a retail chain discern the attributes responsible for the success of a store.

This includes but is not limited to,

- Spending quotient

- Population density

- Footfall

- Affluence index

- Growth trends

- Demand Estimation

- Revenue Projection

From this comprehensive data, a retail manager can understand the probability of success of their retail investments.

You must employ data-backed decisions to build a profitable business in a constantly changing world. Utilizing location data allows retail brands to identify potential lucrative locations for expansion. GeoIQ’s Machine Learning model helps brands identify real opportunities very granularly. Furthermore, the insights generated by GeoIQ’s models help the retail business development teams remove the guesswork in identifying natural growth areas.

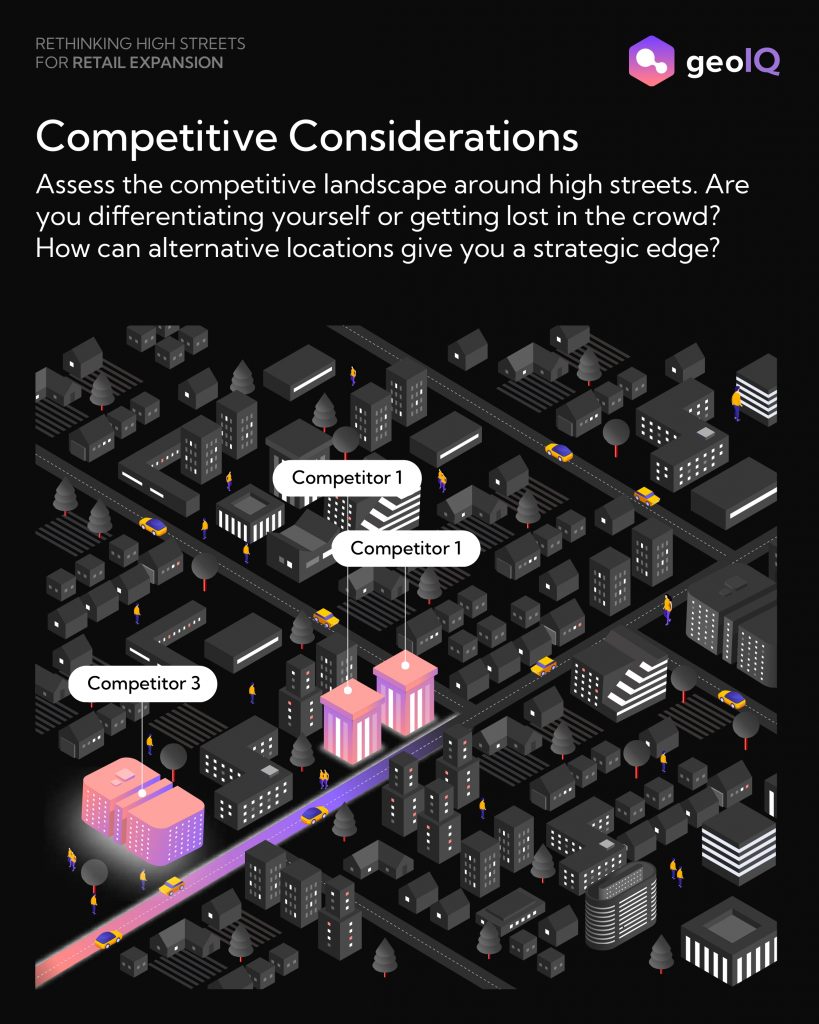

Competitive Considerations

The competitive landscape around high streets is often dense. Retailers must assess whether they differentiate themselves effectively or get lost in the crowd. Exploring alternative locations becomes imperative to gain a strategic edge over competitors.

Have you ever noticed that brands of a category are present near each other?

This is because the presence of the first store demonstrates the profitability of that category in the given location. The stores following the first one estimate that opening a store in the exact location will generate a profit.

However, subsequent stores will eat into the profits of the existing stores. Therefore, there is a need to provide a different customer experience to stand out from the crowd or risk getting lost in the hue of similar colors.

Clustering of retail stores offering similar products often leads to a saturation in the market. According to this article published in the Indian Journal of Science and Technology, retail market saturation is defined as a threshold point beyond which retailers will experience a diminishing return on profit and customer satisfaction.

Your target customer may get confused due to multiple options developing fatigue.

One of the alternatives is to consider locations with a high enough cluster of your target audience that no competitors currently service. Undertaking a citywide analysis to identify these growth clusters will help you determine the locations you can consider for expansion.

Rethinking High-Streets With Data

Rethinking store placements on high streets requires strategic foresight. Businesses should meticulously consider each factor, align with their brand values, and pave the way for an outstanding retail future. The key lies in recognizing that the high street may not always be the road to success and that exploring alternative avenues could unlock new dimensions of growth and revenue.

Historically, high streets have been the drivers of growth in retail. But over the years, the practicality of opening a new store on the high street has diminished. Multiple reasons are contributing to the vanishing allure of high streets.

- The sky-high rents

- Omnichannel growth

- Retail Inflation

- Competition

- Changing demands and demographics

Retail is a capital-heavy business where the average cost of acquiring a new customer is $10. Therefore, a retail business must always manage to convert every single customer into its store. But when presented with multiple options, as on the high street, the customer might be fatigued, as mentioned above.

Employing data-backed solutions like GeoIQ’s machine learning algorithms to identify locations with the highest probability of profit is one of the ways retail businesses can expand without being burdened by the presence of the competition.

Furthermore, GeoIQ’s machine-learning platform will enable business expansion leaders to discover locations experiencing an increased average spending quotient. This is one of the ways they can utilize data to expand into a profitable site.

Leveraging Retail Intelligence With RetailIQ

Employing location-based retail intelligence to determine areas to expand removes the guesswork involved in opening a new retail store. GeoIQ’s model builds predictive revenue generation maps, assisting retailers in shortlisting locations to develop. Retailers can leverage this data to negotiate a better rental agreement, reducing overhead.

Retailers can quickly get an overview of their Total Addressable Market to identify clusters not served by competitor brands and build their stores in these locations.

The data-backed decision helps retailers reduce the losses associated with considering retail expansion through gut instincts. Before the competition, the following site location must be identified in any expanding retail category. RetailIQ’s machine learning model identifies locations where the retailer can improve revenue.