Established markets are often saturated with multiple players competing for the same customer base.

Naturally, most, if not every, retailer would go after underserved markets to get the first mover advantage.

That’s a great idea, as we have seen many brands entering Tier II cities and beyond, such as Zudio, Starbucks, H&M, etc.

But the reality is that picking the perfect location becomes increasingly difficult as the overall viability of a location for your brand changes drastically from one street to another in such underserved locations.

In this article, we’ll discuss how data can help identify and enter underserved markets with your next store.

Understanding the whole picture behind the underserved markets in retail

The characteristics of underserved markets differ from one market to another based on multiple variables such as the local population’s age, gender, spending capacity, preferences, local market trends, competition landscape, etc.

Since these variables vary dramatically, you can’t make decisive decisions based on just a few examples of successful brands breaking into Tier II cities or on any anecdotal data like “this area has seen a lot of new store openings lately” or “people here are starting to spend more.”

These kinds of insights might seem great on the surface, but they’re not enough to justify your investment.

Without understanding the why behind the demand, or lack thereof, you’re essentially flying blind.

What you need is a systematic, data-backed approach that goes beyond assumptions and looks at hard data to uncover true potential.

What makes a market underserved?

An underserved market is a market where there’s unmet demand. This could mean there are no stores catering to a particular income segment, product category, or lifestyle need.

It could also mean that while some players are present, the competition isn’t addressing the needs of a specific demographic.

For instance, a city might have plenty of high-end brands but no affordable fashion options, or there may be growing online demand in an area with limited offline availability.

To identify this kind of gap, you need to look at:

- Purchase behaviour patterns: Are people in the area actively spending on similar products elsewhere (online or in nearby locations)?

- Brand affinity: Is your brand or category already popular in the region, even if there’s no physical store?

- Competitor saturation: Is the current competition failing to serve certain customer segments effectively?

These indicators help move beyond surface-level assumptions and make decisions based on real-world conditions.

Risks while opting for such locations

While the opportunity is real, entering underserved or untapped markets isn’t without risks.

One of the most common mistakes brands make is assuming that simply being present in a high-demand area is enough.

In reality, misreading the market can backfire quickly.

Here are a few risks to watch for:

- Mismatch in product or merchandise mix: Offering the wrong range of products that don’t cater to local tastes or utility.

- Inappropriate pricing: A price point that works in metro cities might be too high (or too low) for customers in smaller cities or upcoming neighbourhoods.

- Cultural disconnect: If the brand messaging or store experience doesn’t resonate with local values or shopping behaviour, customers may ignore it altogether.

- Overestimating demand signals: Not all footfall is relevant footfall. Just because a location is crowded doesn’t mean those people are your target customers.

The bottom line is that demand alone isn’t enough. You need the right fit between what you offer and what the market needs.

| Related: GeoIQ recommended merch-mix saw 45% more sales!

How can you find untapped locations for your retail brand?

To start off, you need to find not only where the opportunities lie, but also where your brand truly fits in the market.

That starts with understanding your own brand and product first—what you offer, who it’s for, and what makes it different.

Once you’re clear on that, identifying the right locations, audiences, and strategies becomes a lot easier.

Step 1: Create a persona for your product or service

Before you even begin scouting for locations, you need to have absolute clarity on who your customer is.

Not just at a broad demographic level, but in terms of behaviour, intent, and lifestyle. This persona becomes the anchor point for every location decision you make.

Start by answering:

i) Who is your ideal customer?

Are they young professionals, students, working parents, or retired individuals?

Example: A brand like Zudio might focus on budget-conscious millennials who want trend-led fashion at affordable prices.

ii) Where do they typically live or work? (on a broader level)

Are they concentrated around college clusters, IT parks, high-street markets, or residential suburbs?

iii) What do they value most?

Is it affordability, convenience, variety, exclusivity, or a premium in-store experience?

iv) How do they shop?

Are they impulsive or planned buyers? Do they prefer online browsing before offline visits? Are they brand-loyal or deal-driven?

By building this type of detailed persona, you’re defining the type of locations that would naturally attract and convert them.

This step ensures that your location search isn’t generic, but laser-focused on where your brand has the highest chance of resonance and success.

Step 2: Identify markets where this persona is present but underserved

Now that you’ve built a clear customer persona, the next logical step is to identify geographies where this audience exists but their needs are not being fully met.

This is where most brands either overestimate demand based on visibility (like crowded markets) or underestimate opportunities because there aren’t enough “known” competitors.

Instead of going by gut feeling or word-of-mouth trends, you need to ask:

- Are there catchments with the right income group, footfall profile, and lifestyle preferences where your category is underrepresented?

- Are customers in these locations purchasing similar products online, but don’t have access to them offline?

- Is there a high search demand for your product category but no brand presence nearby?

These questions and more should be asked before scouting locations for your next store.

But doing this by fieldwork takes ample time, and you may not search for a market that isn’t under your radar or that is known to you.

Instead of limiting yourself to a few cities, you can utilise location intelligence tools to scout for markets that are truly underserved.

How GeoIQ helps identify high-potential, underserved markets at scale

GeoIQ’s RetailIQ combines location data, consumer behaviour, and machine learning models to help you identify markets with high demand potential but low brand saturation – the true underserved markets.

Here’s how RetailIQ helps you do it from 0 to 1:

1. Pinpoint your persona across multiple locations

The platform helps map your ideal customer persona across different cities, towns, and even down to the street level across India.

By tapping into demographic, behavioural, and socio-economic data, you can:

- Identify where your target customers (based on age, income, lifestyle, etc.) are located

- Understand the concentration of key segments, such as professionals, students, or parents

- Focus on areas where your specific customer group is more likely to be

This way, you avoid generic location searches and get hyper-targeted with your expansion plans.

2. Uncover demand where supply doesn’t exist

It’s easy to assume that a busy area already has everything, but our platform goes beyond surface-level observations.

Using data-driven insights, the platform uncovers locations where demand exists but the supply is still lacking.

A few of the key capabilities include:

- Online behaviour analysis: Understand where your target audience is searching for products but hasn’t found any physical stores to fulfil their needs.

- Search trends: GeoIQ tracks growing interest in specific products or services in specific regions, helping you tap into high-demand markets.

- Competitor gaps: Identify where the competition is and the catchment area they serve.

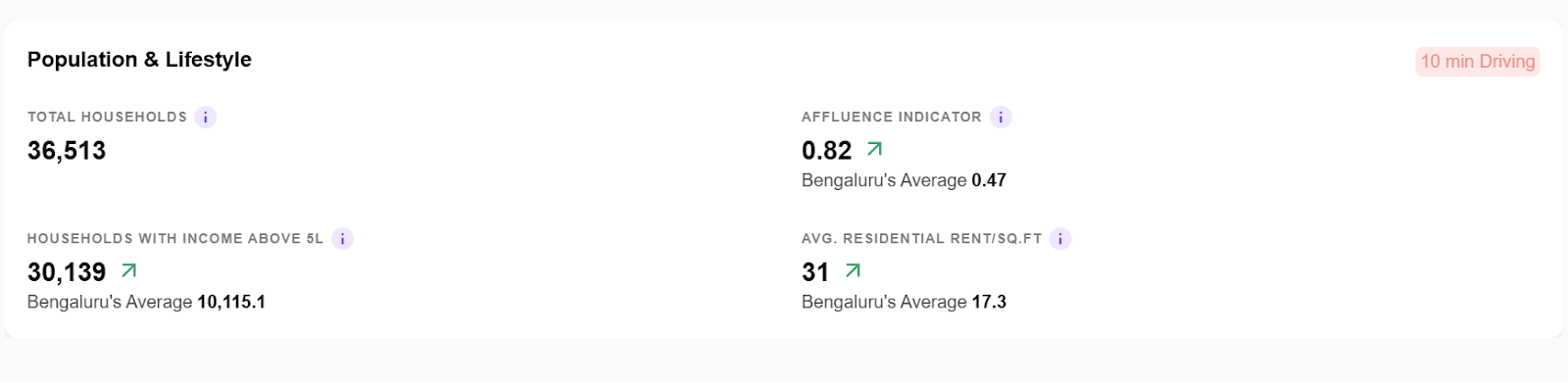

3. Assess market viability & potential

To help you make decisions beyond just identifying demand, we help you assess the market’s viability in different criteria.

- Revenue potential: Forecast the expected revenue of entering a specific market, based on historical sales data and market conditions.

- Maturity and performance period insights: Determine how long it will take for your store to reach breakeven and how consistent the demand will be across seasons or even years.

4. Rank and prioritise high-potential locations

Not all underserved markets are equal.

Some may offer more growth opportunities than others. Our platform automatically recommends the perfect locations based on a scoring system, which can be customised to your needs.

For instance, you might give footfall and high household income more priority than complementary or competing brands in the market.

You can also compare locations in a single dashboard, helping you clearly understand which underserved market offers the best fit for your brand.

Comparing locations in Retailiq’s site report

This level of granularity ensures your decision ends up profitable and aligned with your brand’s goals.

Final thoughts

Underserved markets give you an immense opportunity to gain a first-mover advantage.

But capitalising on them shouldn’t be about being first alone—it’s about being right. The right location, the right product-market fit, and the right timing.

With our tool, you now have the power to make expansion decisions backed by data.

Book a 15-minute discovery call with us to help you choose and prioritise the best, underserved markets for your retail store!