Retail clustering helps dissect the local market better and put it under multiple buckets – so that the retailers can personalise everything – from the shopping experience, product mix, prices and more.

For instance, the products and the shopping experience you get while visiting a well-known retail chain in a metro city are different from visiting the same chain in a Tier 2 city.

This is one of the typical works of retail clustering.

These clusters can also be used as a tool for expansion strategies. So, getting clusters right is critical and can be the foundation for success.

This article focuses on different types of clusters and how you can create clusters that actually make sense, backed by real-world data.

Let’s break it down.

What is retail clustering?

Retail clustering is the process of grouping your stores based on shared characteristics – in terms of sales, customer type, buying behaviour, or even location type (high street, mall, etc) and then grouping them together.

Each cluster/bucket can then be treated differently – different products, different pricing, and even different marketing campaigns.

For example, a store in South Delhi might stock more premium, fashion-forward items, while a store in Coimbatore could focus on affordable and traditional wear.

Clustering helps brands avoid making assumptions and instead work with data-backed insights.

Why does retail clustering matter?

As we mentioned, customers in Delhi aren’t the same as customers in Coimbatore.

Also, it actually differs drastically even within the same city. The audience around a university is different from one in a high-income residential zone.

Without clustering, you end up treating all your stores the same, which isn’t ideal.

But when you cluster smartly, you can:

- Personalise your product offerings

- Avoid overstocking or understocking

- Improve campaign targeting

- Boost overall customer experience

Also, retail clustering solves real problems for both the brand and the customer.

For brands/retailers, it can:

- Curate product(s) that actually meet customer demand Save inventory costs by reducing stocking issues

- Improve store sales

- Find new locations for expansions easier

On the flip side, for customers, it can:

- Satisfy precise customer needs, tailored to their preferences

- Ensure better product availability

- Provide a more relevant shopping experience

- Offer prices that match local purchasing power

| Cluster smarter with GeoIQ for better targeting, merchandising, and expansion strategies!

Types of retail clustering

Retail clustering uses different metrics to form the buckets. Below are the three major types that retailers may prefer:

1. Store clustering

Store clustering groups retail locations based on similarities across multiple dimensions that are associated with individual stores :

- Location attributes – Urban/suburban/rural positioning, local demographics, etc

- Performance metrics – Sales volume, foot traffic, conversion rates

- Physical characteristics – Store size, layout, format

- Operational factors – Staffing levels, inventory capacity

By analysing these dimensions across multiple stores, a retailer can group the stores with similar profiles – to tailor merchandise strategies, marketing strategies, etc. to each cluster’s unique characteristics.

For example, a national clothing retailer might discover that their stores naturally cluster into:

- High-volume, fashion-forward urban locations with demand for the latest trends

- Stores located in areas with a younger population

- Locations in premium neighbourhoods where luxury and brand value drive purchases

Once identified, these clusters would then receive customised merchandise assortments and marketing strategies aligned with their specific customer base.

| Related: Merch-mix recommended by us helped a brand see 45% more sales!

2. Product clustering

Product clustering focuses on grouping products or product categories based on the product’s shared characteristics.

Product clustering can be grouped based on:

- Performance data – Sales velocity, margin contribution, seasonality

- Physical attributes – Size, colour, price point

- Customer behaviour – Purchase patterns

- Supply chain factors – Lead times, vendor reliability

This type of retail clustering helps retailers optimise their product assortment, improve shelf placement, and drive cross-selling.

For instance, products that frequently sell together can be grouped together as a combo deal or merchandised as complementary offerings.

3. Customer clustering

Customer clustering involves grouping customers based on their shared characteristics, behaviours, and preferences.

Customer clustering segments shoppers based on:

- Demographics – Age, income, household composition

- Purchase behaviour – Frequency, preferences, spending capacity

- Channel preferences – In-store, online, mobile app

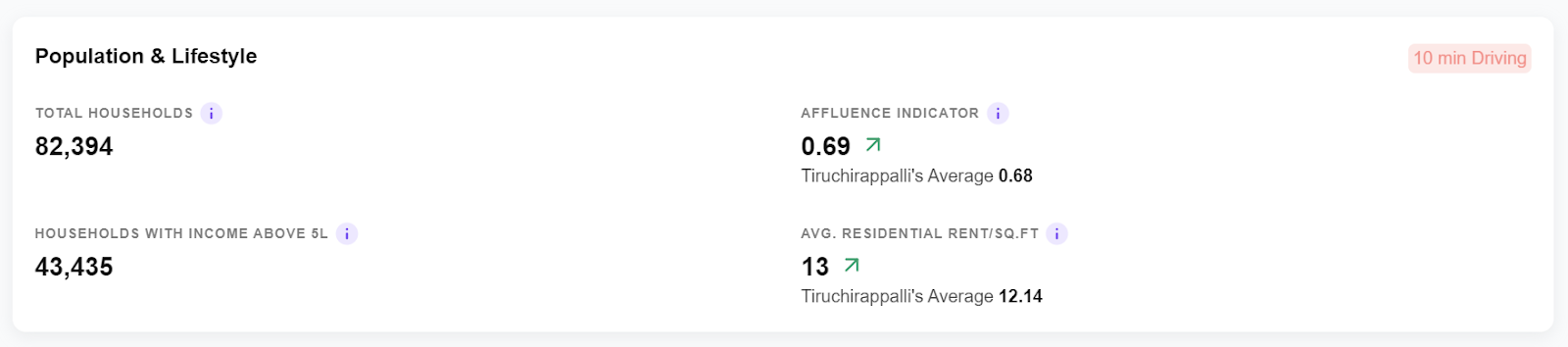

Source: GeoIQ’s site report

With clearly defined customer clusters, retailers can develop personalised marketing campaigns, loyalty programs, and shopping experiences that resonate with each segment’s unique preferences.

For example, a retailer might identify a cluster of young, tech-savvy shoppers who frequently purchase through the mobile app. This segment can be targeted with app-exclusive deals and early access to new launches.

Meanwhile, a separate cluster of high-value customers prefers in-store shopping, signalling that the retailer should focus on personalised services, convenient parking facilities, etc.

Why you should consider all variables instead of just one?

Whether you’re planning to expand your offline presence, tailor merch strategies or run targeted campaigns, clustering should have a multi-dimensional approach rather than relying on a single type of retail clustering.

Traditional cluster methodologies didn’t adapt to real-time changes and often ignored deeper customer behaviour on a street level and never took local competition and their dominance into account.

Consider this example: A retailer may cluster stores based solely on sales volume, creating “high-performing” and “low-performing” groups. Based on this simplistic clustering, they may implement standardised improvement strategies for all “low-performing” stores.

Basically, using a one-size-fits-all approach which won’t work like it did before.

But when this case is analysed through a multi-variable lens, a very different picture could emerge:

- Some stores may have strong footfall but low conversion rates, signalling an issue with merch mix or pricing.

- Others might be in high-competition zones, requiring better promotions or differentiated offerings.

- A few may serve distinct customer segments (like senior citizens or students) that need tailored experiences altogether.

It’s evident that clustering by just one or two metrics can lead to the wrong diagnosis and the wrong solution.

Instead, you should combine sales data with other datasets such as, foot traffic, customer demographics, catchment profiles, and competitive intensity to form meaningful clusters that reflect how stores really behave.

How GeoIQ makes clustering smarter

At GeoIQ, we help retailers move beyond one-dimensional clustering. Our platform brings rich, real-time data into your decision-making process.

We combine multiple geospatial and behavioural data signals, including:

- Foot traffic (hourly, daily, monthly) at a street level

- Catchment area characteristics

- Demographics and lifestyle indicators

- Local competition density and dominance

- Ideal customer density

- Demand patterns and affluence levels

By integrating these diverse data sets, our platform helps you build clusters that reflect how customers actually shop. This means your strategies – whether for merchandise mix, pricing, marketing, or expansion – are based on real context, not assumptions.

Final thoughts

Retail is getting more personal.

Customers want stores that get them. Brands want stores that perform better, and retail clustering is how you could bridge that gap.

With GeoIQ, you can build smart cluster groups and develop scalable retail strategies that adapt in real time and take every relevant context into account.

Schedule a 15-minute demo with us to understand how we do this in detail and how we can develop one for you!