“Don’t go offline when you want to, go offline when your users want you to!”

- Arjun Vaidya, Co-Founder @ V3 Ventures

The internet has transformed the business of Direct-To-Consumer (DTC) brands thanks to increasing digital penetration. This has led to the adoption of digital payment methods, an increase in market awareness of consumers, and the rise of hyperlocal businesses. The confluence of these factors is responsible for the mushrooming of home-grown DTC brands like Nykaa, MamaEarth, and Licious, among others.

But, how will these DTC brands sustain their growth in a crowded digital space?

The answer lies in going offline and adopting an omnichannel strategy. But what is the right time to make this shift? Let’s explore the answer in this article.

But before that, let’s understand why D2C brands need to go offline.

Why Should a DTC Brand Go Offline

Before attempting to solve a problem it is prudent to analyze the underlying factors behind the problem. Retailers who wish to start their first physical store should establish the reasons why they need to expand offline, before considering when they should expand.

The Halo Effect of Brick-and-Mortar Stores

Did you know that a DTC brand could increase its sales by 6.9% just because of the presence of its physical store?

This is because of a phenomenon called the halo effect of brick-and-mortar stores.

Consider that you are a digitally native brand selling to customers across the country. You decide that you are going to open your first store in a high street in one of the major cities in India. You might expect a considerable bump in sales from this physical location.

But what you wouldn’t expect is an increase in online sales from customers who visit your website after leaving your physical store. This is because of the halo effect of the physical store on online sales. And this is a relationship that works the other way around as well.

A study conducted by the International Council of Shopping Centers found that for every $100 spent at a physical store, the same customer would then spend an additional $160 at their online store. Vice versa, the customers who shopped at an online store would spend $231 at a physical store location.

DTC brands can understand consumer behavior with the help of characteristics of the location where they live and shop. This would help to increase sales by a further 40% by providing online pick-up at-store options for their purchase. The positive feedback loop of the halo effect of brick-and-mortar stores is one of the reasons why we have predicted it to be one of the defining retail trends of 2024.

Physical stores augment the online sales of DTC brands and vice versa, this is connected to the evolving principle of omnichannel retail.

Buying Patterns: Touch Is a Sensation That Is Tough To Beat

The digital transformation of retail business ushered in a new paradigm in consumer behavior. The online marketplace brought products from far away shores in front of a five-inch mobile screen. But, even in this age some products still require the human touch. And brands that are expanding in this space are exploring avenues to exhibit their products.

Consider if you are a retail owner of a jewelry store, you could place your designs online and even provide AR interfaces to help your customers get a “feel” of the product. But, it will never replace the real thing. People value the sensation of touch.

Humans are a curiously funny species. For all the din we make about the convenience of online shopping, the reptilian brain relishes the satisfaction of physically holding an object.

Psychology even has an endearing term for it – the endowment effect.

The explanation behind this psychological phenomenon is that if humans touch or feel an object, we are likely to think that we own it. And, if we believe we own it, we tend to purchase it.

This is the reason why every Apple store and most mobile showrooms allow the customer to touch and interact with the devices. When a retailer’s product requires this physical interaction to make the sale, having an online store alone will not suffice. Consider the example of Nykaa which is expanding new stores in the offline retail space.

There are also brands like SleepCompany, FabIndia, and Ikea, which offer customers an experience with their products. This allows the brands to have complete control over the way their customers interact with the brand.

Brands that require physical contact to boost their sales should consider opening an offline retail store to boost their sales and improve customer satisfaction.

When Should You Start Your First Physical Store?

Now that we’ve answered the why and briefly referenced the omnichannel strategy employed by most companies transitioning into the physical space, let us consider the when.

Achieving Product-Market Fit For a DTC Brand

A product idea becomes a great product when it can achieve product-market fit. What this essentially means is that the product can solve the problem of its users, and the users are coming themselves to explore the product without excessive marketing and advertisement.

A DTC brand can measure its product-market fit by monitoring the number of evangelists for their product. And if the brand has created a cycle of repeat customers while reducing the CAC over time.

When a DTC brand begins to steadily increase its market share with minimal complaints about issues resulting from its product, then the brand can start to consider opening a physical store to accelerate its growth and capture a larger market share.

Financial Stability For a DTC Brand

Financial discipline is a virtue developed over time. A company that displays positive cash flow without getting overburdened by debt is the golden child in any industry, particularly in a capital-intensive industry like DTC retail.

Let us consider the factors impacting the increase in spending and the methods implemented to reduce the cash burn.

Avoid Profit Losses Due to Increasing Customer Acquisition Costs

“No digitally native brand has achieved a billion dollars in annual revenue without a store. You need those stores as a cost-effective customer acquisition channel at some point.” – Jason Goldberg, chief commerce strategy officer, Publicis.

Shopify reported a 200% increase in the number of online storeshops opened in the two years between January 2020 and January 2022.

Now, the previously inexpensive cost to acquire a new customer steadily inches toward becoming unsustainable. Just consider the following example, where the CAC of a company increases while the other factors remain constant.

Sample CAC Model

| Year | AOV | Margin | CAC | Profit on first order | Products to sell to generate profits |

| 2021 | ₹400 | 60% | ₹200 | ₹240 | 1 unit |

| 2022 | ₹400 | 60% | ₹300 | ₹240 | 2 units |

A 50% increase in the CAC doubles the number of units the retailer should sell before they can turn a profit. In the real world, various other factors reduce the profitability of an operation ranging from Opex, Capex, Warehousing, and product return, etc.

The 50% increase is a conservative estimate, given that the CPC of Facebook Ads has increased from ~0.31 to ~0.50 in the calendar year 2021, an increase of approximately 61%. An increase that is enough to eat into the profit margins of most online first companies.

Most digitally native stores reach this saturation point after a few years of frenzied growth, where the CAC increases and the profit decreases. And in a world besieged by a funding winter, brands have to consider avenues to boost their profits. Opening a physical store is one of the tried and tested methods in retail expansion.

Reducing Overheads: Lower RTO and Platform Fees

If you were a pure-play online apparel retailer, what do you think is the biggest problem hampering your growth today?

It is the cost associated with the return of product, or return to origin. Online apparel retailers deal with 50% return on most items. When factoring in the logistical cost for a single return, a picture of the true gravity of the problem begins to surface.

Once an apparel brand has achieved market penetration, it should consider opening its physical store to both reduce the cost of acquiring new customers and increase the visibility of its brand.

For fashion brands that are unsure of their success, they can consider opening a pop-up store in the locations they have short-listed to gauge the purchase intent of their target audience.

For fashion brands that are exploring their potential for success, they can consider opening a pop-up store in the locations they have short-listed to gauge the purchase intent of their target audience.

Furthermore, if you were a retailer who exclusively sells on online marketplaces like Amazon or Flipkart, you have to bear the platform fee and commissions which stretch your margins.

By some estimates, brands pay close to 30%-40% of their selling price as marketplace fees and shipping cost deductions. Moreover, online marketplaces do not provide a comprehensive view of your customer’s profile. For example, if you were a brand selling your product exclusively on an online marketplace, then you would only get the pin code of the locations from where your product was purchased.

With such rudimentary data will you be able to run high-converting targeted ads? With increasing ad costs, as mentioned above, the break-even point for digitally native brands is on the rise.

However, transitioning to a physical store allows the retailer to accurately predict the merchandise mix creating value in a given location. And, opening stores close to their customers help retail brands develop a comprehensive profile of their target audience.

Experts recommend that the first three years of a retail business should be devoted to ironing out the kinks in the operation. And only then start their journey into the world of physical retail stores.

Brand Strategy For a DTC Brand

The future of retail will experience the transformative effect of omnichannel integration. DTC brands seeking to open their first physical store should adopt technologies that facilitate the seamless integration of the offline and online shopping experience.

Let us explore the prerequisites that a DTC brand should consider before starting their first offline store.

Achieving Tech Ability for Omnichannel Strategy

Omnichannel retail is the buzzword revolutionizing the retail experience in 2024. Before a brand considers opening its first physical store, it should ensure that the technologies required for a seamless omnichannel experience are present.

From eyewear manufacturers using Augmented Reality to help customers visualize their purchases to apparel brands replicating their offline products online. Leaders in retail have begun to embrace the changing landscape with gusto.

What is the reason behind the need to operate a functional Omnichannel business?

The ICSC study mentioned above identifies that while omnichannel retail only represents 17% of total shoppers, they contribute to 34% of the total sales (when compared to customers who only shop offline or online).

And then there is an added advantage for customers who choose the Buy Online Pick Up in Store mode to purchase their goods. This payment mode leads to a 40% increase in sales due to customers who make additional purchases when they come to pick up their orders.

DTC brands considering starting their offline business expansion have to incorporate omnichannel strategies to leverage customers to provide a seamless end-to-end shopping experience.

A noteworthy example of this in India is that of Lenskart. The brand allows customers to choose their eyewear online, try it out at their physical store, and get it delivered to their house.

A checklist of omnichannel prerequisites before a brand considers an offline pivot

- Employing an integrated tech stack that ensures smooth operation between the offline and online facets of the business.

- Invest in a fluid sales automation system to ensure that customers can continue their online journey offline, or vice versa.

- Apply data analytics to understand better and segment your online audience to identify the patterns of success.

- Discern customer habits and optimize the brand’s online presence for the everyday activity of the target audience.

- Create a robust automation system to connect with your customer at each point of the buying process through targeted marketing messages at each part of the funnel.

Funding and Investment For a DTC Brand

There is an adage as old as time itself, money makes the world go around. In the current age, the capital of investors is the fuel driving the growth of digitally native retailers.

But there is only so much liquidity in the private markets after which retailers have to consider going public. The magnitude of liquidity rushing into a retail brand during its Initial Public Offering is the biggest cash flow that any company can generate in a short period.

Before filing the papers for an IPO with the securities exchange, most retailers would start to aggressively expand their footprint of physical stores. This is due to a variety of factors including,

- The large presence of physical stores reduces the CAC

- Improving brand awareness

- Showcase high revenue and scalability

Creating that first set of repeat customers is a feather in the cap of any retailer. But, the trouble starts when you start looking for customers outside the immediate target group. You will have to stand out and leave a lasting impression on your wider target audience.

When a retailer opens their physical store in the pincode corresponding to the large online order, they are fulfilling two conditions for future expansion.

- They are catering to an existing customer base

- The presence of the physical store serves to increase the visibility of the brand in front of its potential customers.

Customer Demand For a DTC Brand

The treasure trove of any DTC brand is its customer list painstakingly serviced by the brand. If the brand operates its online store, this will include the exact address of its customer. Once a brand grows large enough, and if it starts to notice a higher incidence of customers from a particular location, then it can consider opening a physical store in that area.

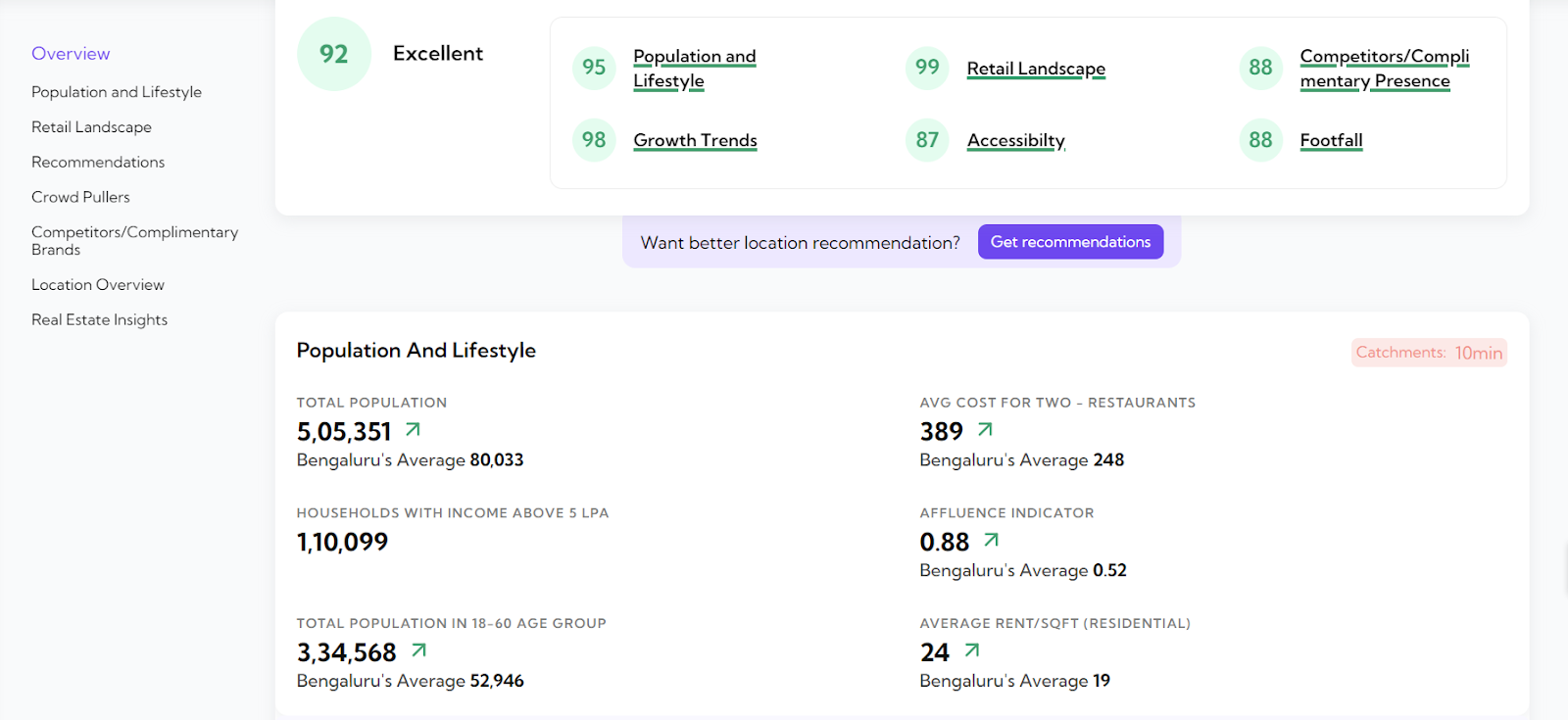

DTC brands can now unlock the hidden potential of any location by blending their customer data with location insights on population density, affluence, and even competitor presence. This data fusion paints a vibrant picture of demand, guiding brands to pinpoint the most profitable destinations for their first physical store.

This site report generated by RetailIQ gives expansion heads the key to unlocking retail success. With a quick comparison to their own data, they can find the perfect spot for their first physical store.

A DTC brand should open its first physical store only when they have identified the existence of customer demand in its target location. One of the ways they can establish the demand market for their product is to determine the presence of their competitors and complementary brands in the location.

Recap: When Should a DTC Brand Open Its First Physical Store

These are the broad must-haves a brand should possess before starting its transition into a physical store.

- When the cost of customer acquisition starts to become impractical beginning to reduce the profit margins of the online retail operation.

- When the brand’s products require a physical touch point to generate desirability.

- When the brand’s technology stacks work seamlessly between its offline and online businesses.

- When the brand is considering going public it requires a flush of capital a magnitude greater than what is offered by private markets and build its brand.

- When the brand wants to reduce third-party fees and losses from item returns.

Employing Data Analytics Capabilities to Find an Ideal Location

Deciding to open their first physical store is a momentous decision for any digitally native retail brand. The physical retail sector in India requires a nuanced understanding of the interplay between multiple factors. With competition from both unorganized and organized retail stores, the success of a DTC brand’s first physical store hinges on selecting the correct location.

Location data therefore becomes imperative in helping choose the sites where the DTC brand can put up their store.

Conclusion

When digitally native brands transition from online to offline they have to consider multiple factors. From skyrocketing CAC to when the customers of the DTC brand crave that tangible connection with the product.

But it’s not just about reducing losses and cutting third-party fees. It’s about finding that sweet spot where your brand becomes a real name on the streets the customers of the brand frequents.

And in this era of data, let’s not forget the importance of analytics. GeoIQ steps in as the location analyst, helping DTC brands select the perfect spot for their first physical store.

It’s not just about going offline; it’s about doing it right, backed by insights and a dash of human intuition. Ready for the next chapter in your brand’s story? It starts with finding the ideal offline home.