In the dynamic realm of retail expansion, discovering new opportunities in smaller cities (like tier II and tier III in India) is like finding hidden treasures. But there’s a big problem—businesses often don’t have enough information about these places, hindering them from making informed decisions. In this article, we’ll explore how using location data can change the game for retail businesses, making their expansion plans into newer markets, smarter.

When Should Businesses Consider Expanding to a Tier 2 and Tier 3 City?

Choosing the right time to expand into Tier II and Tier III cities is a strategic decision. Factors such as market saturation in larger cities, changing consumer preferences, and a comprehensive analysis of available location data can guide businesses in determining the opportune moment to venture into these untapped territories. Understanding the readiness of the business, coupled with a data-driven approach, enhances the likelihood of successful expansion.

One can clearly witness a radical shift in consumption and spending patterns of small-town consumers as they move beyond necessities and indulge in products and brands that were once available and sold only in urban areas. The rise of the small-town elite is also opening doors for luxury brands to enter markets beyond metros.

Moreover, higher rentals and lower footfalls in shopping malls in larger cities are pushing retail brands to look for better markets with lower rentals and higher density of target audience. Such markets are now popping up in the tier II and III cities of India.

The article focuses on the current challenges that retail brands face while entering these unknown markets and the way forward through data-backed strategic decisions.

The Dilemma of Data Deprivation

For retail giants eyeing expansion into tier II and tier III cities, the scarcity of critical information regarding market dynamics, customer attributes, and competitor performance has long been a stumbling block. The absence of data on footfall, market trends, user mobility, and historical sales data makes the process of site selection and revenue projection a speculative endeavor.

What works in big cities doesn’t always apply to smaller ones. So, businesses end up hesitating to expand, not knowing which direction to go.

Scaling Challenges: Overcoming the Hurdles of Growth

While the potential for growth in tier II and tier III cities is immense, businesses must be prepared to face scaling challenges. The unique characteristics of these markets, combined with varied consumer behaviors, demand a flexible and adaptive approach. Overcoming logistical challenges, and supply chain considerations, and ensuring a seamless customer experience are crucial elements in successfully scaling operations in these regions.

Location Data: A Game Changer

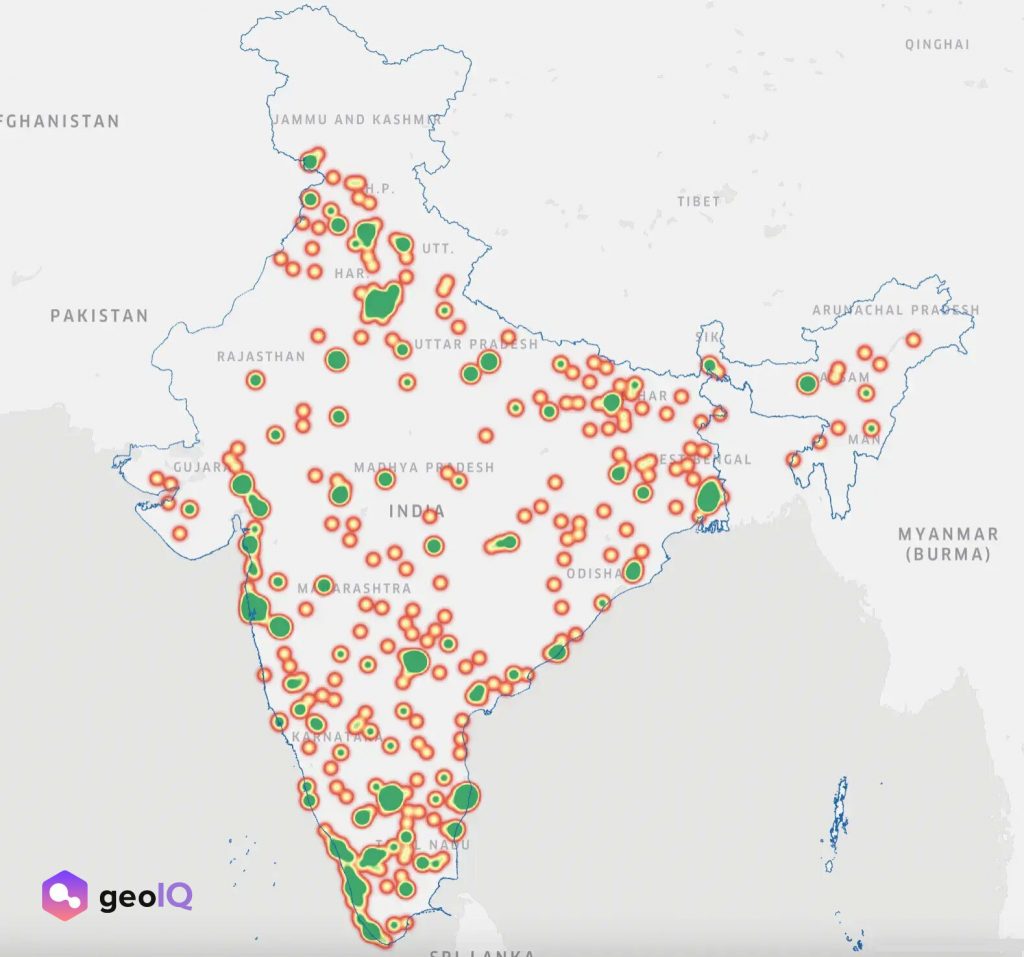

Enterprises across the retail sector are awakening to the transformative potential of location data in overcoming the hurdles posed by the information black box. By harnessing publicly available location data, businesses can employ advanced machine learning models to gain street-level insights into specific catchments. This enables a comprehensive understanding of the characteristics of the local population and facilitates data-driven site recommendations.

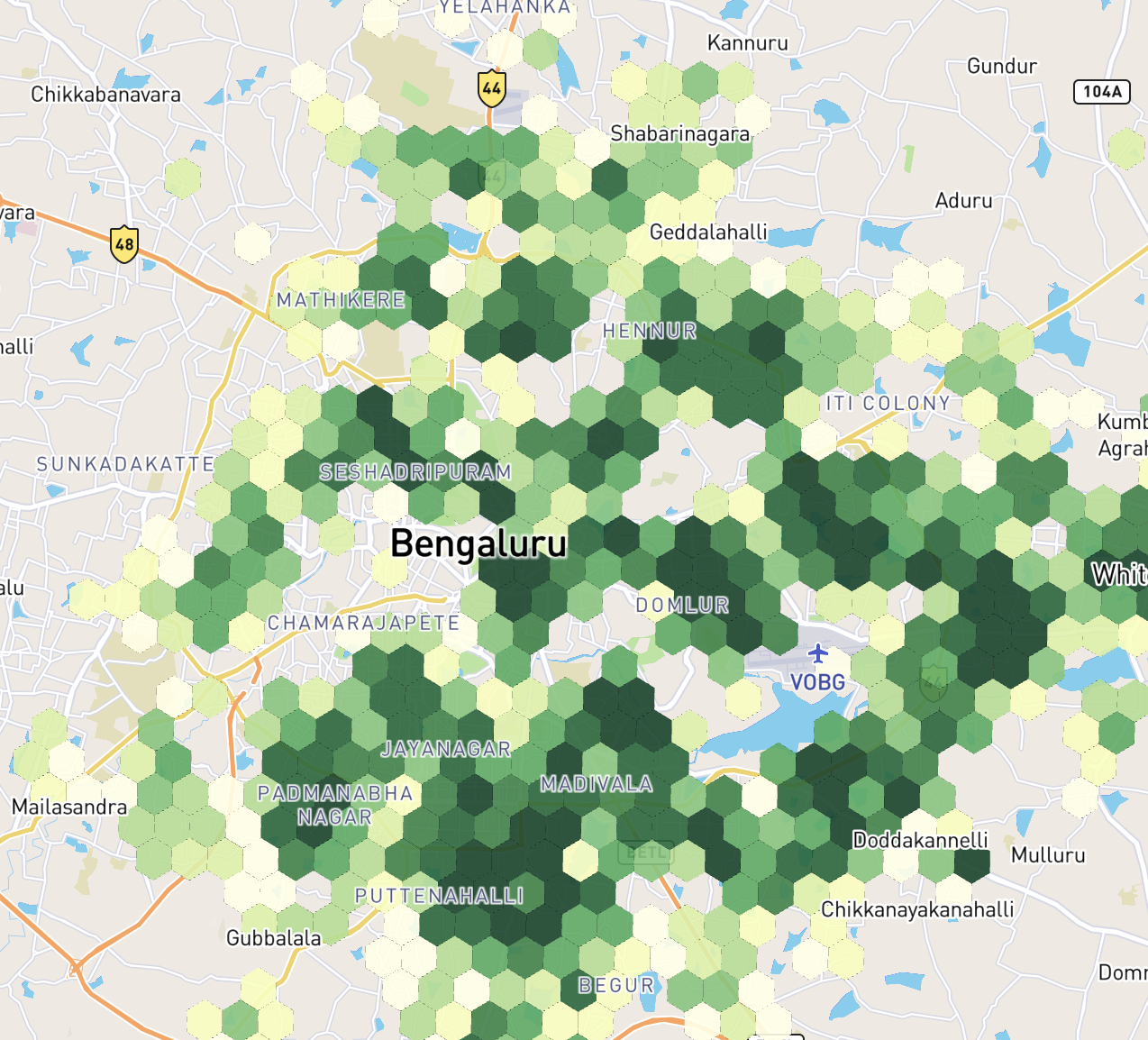

Also, when the answers are drawn at the street level rather than at the pin-code level, businesses can make pin-pointed decisions and differentiate one street from the other to optimally place their new stores. Such granular insights help businesses identify the best possible spot to open a store with maximum success propensity, eliminating the risk of closure. This ultimately translates to saving set-up costs of the stores that will eventually close and maximize revenue potential at the store level.

Understand TAM and Demand Patterns

Location data also helps retail businesses understand the Total Addressable Market and demand patterns in specific catchments. Foot traffic data, mobility patterns, and other geo-characteristics of the population help businesses understand where their target audience resides, where they shop, what is their spending capacity, what are their buying behaviors and much more. All this data provides critical insights into TAM and demand patterns city-wide but at street level.

Source: Geoiq.ai

Site analysis driven by real-world data proposes an accurate picture of exactly how things unfold at specific locations. With a street-level overview of the site, the accuracy of data and insights generated is unmatchable.

Navigating the Future: Opportunities and Trends

As the retail market in tier II and tier III Indian cities undergoes a paradigm shift, brands that adeptly leverage this expansion opportunity are poised for substantial market share beyond metros and tier I cities. The article concludes by examining the potential impact of successful expansion and how businesses can capitalize on emerging trends.

The Omnichannel Movement

The evolving consumer behavior, especially with the rise of e-commerce and increased digital connectivity, understanding and adapting to these changes are crucial. E-commerce and D2C brands are now moving offline to develop an omnichannel ecosystem and bring in synergy among the online and offline sales. Even though the first set of stores for most online commerce businesses would find a place in the metropolitans and tier I cities, the next order of business could be entering the tier II and III cities. Again, when and how to expand to these markets would be a strategic decision in time.

The Brick and Mortar Halo Effect

A noteworthy trend gaining prominence is the halo effect of brick and mortar. As businesses continue to navigate the dynamic landscape of consumer preferences, the strategic integration of physical storefronts has become a pivotal element in shaping brand perception. The allure of a well-crafted and inviting physical store is proving to have a lasting impact on consumers, creating a positive halo that extends beyond the confines of the store itself.

This trend emphasizes the symbiotic relationship between online and offline retail channels, with a physical presence fostering trust, authenticity, and reliability. Retailers are recognizing the halo effect as a powerful force that not only enhances the in-store experience but also positively influences consumers’ perceptions of the brand across various platforms. As the retail landscape evolves, the harmonious blend of brick-and-mortar establishments with digital initiatives is poised to be a defining strategy in shaping successful retail expansions.

The Infrastructure and Digital Payments Transition

The burgeoning appeal of retail brands in Tier II and III cities can be attributed not only to shifting customer behaviors but also to significant infrastructural enhancements and the accelerated adoption of digital transactions. Beyond the traditional urban landscapes, these cities have witnessed substantial improvements in transportation, connectivity, and overall infrastructure, facilitating smoother supply chains and logistics for retail operations.

Simultaneously, the pervasive reach of digital technologies has catalyzed a paradigm shift in the way transactions occur. The rising trend of digital payments and online shopping has found resonance in these cities, creating a seamless bridge between physical and digital retail experiences.

As these regions embrace technological advancements and modern conveniences, retail brands are finding a welcoming environment in Tier II and III cities, tapping into a previously underserved market and fostering economic growth in these dynamic urban centers.

The brands that understand and adapt to these changes stand to gain a competitive edge in this evolving market.

Real-world Impact: Lenskart’s Storefront Success

Lenskart, a retail powerhouse, stands as a testament to the real-world impact of leveraging location data in expansion strategies. Having opened 1400+ stores across India, Lenskart’s journey underscores how analyzing the characteristics of potential locations and predicting store success rates can minimize risks associated with closures. This success is not confined to Lenskart alone; it sets a precedent for the retail industry as a whole.

Conclusion:

Integrating location data and intelligence into expansion strategies not only addresses the challenges posed by the lack of information but also propels retail businesses toward informed, logic-backed decisions. The Lenskart example serves as a beacon, showcasing the limitless possibilities that await those who unlock the doors to unprecedented growth in untapped territories.

With the right approach, businesses can navigate the complexities, overcome scaling challenges, and strategically expand into tier II and tier III cities, positioning themselves for success in a rapidly evolving retail landscape.