In the heart of Delhi, nestled amidst bustling avenues and whispers from a long past, lies Khan Market – a microcosm of the city’s vibrant energy, where designer handbags glimmer like trophies and rents rival their shine. But what elevates this seemingly unremarkable cluster of storefronts to the prestigious ranks of the world’s most expensive high streets?

Let’s unravel the mystery behind its fortuitous rise and discover the secrets that make Khan Market India’s premium pin code.

Location Maketh The Street

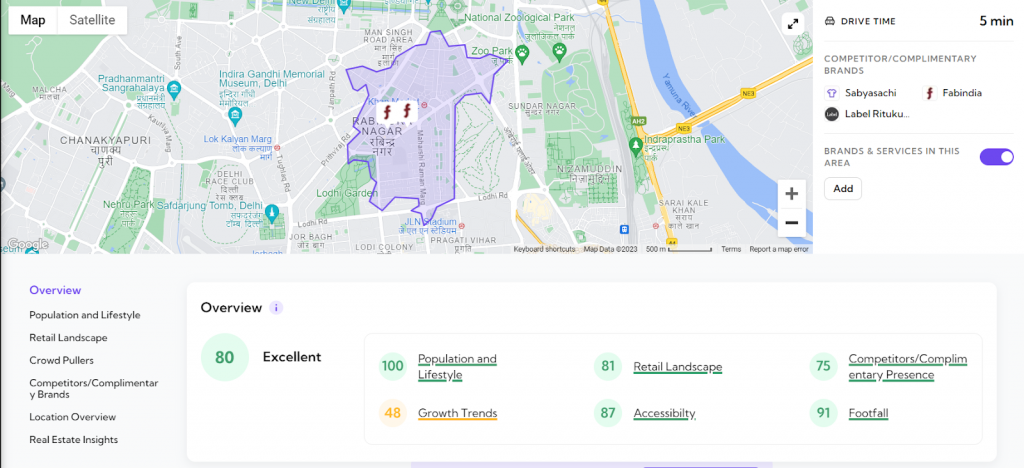

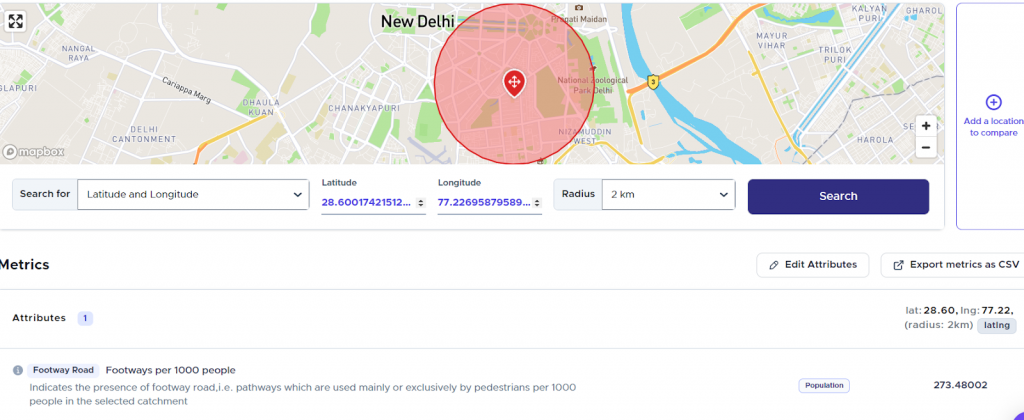

This visual depicts the trade area of an imaginary apparel store situated in Khan Market. Following a thorough analysis of the diverse factors influencing the store’s success, the RetailIQ engine has succinctly categorized them under six key headings.

Location, they say, is everything. And Khan Market holds this adage like a coveted jewel. Nestled in the lap of Lutyens’ Delhi, it boasts unmatched walkability. Statistics reveal an impressive walk score of 86, simply put; pedestrians can access all the stores at this location easily. Khan Market is surrounded by affluent residential neighborhoods like Lodhi Estate and Golf Links, locations where the biggest names in Indian politics reside within earshot of the high street. National government buildings and foreign embassies also surround Khan market and is easily accessible by employees working in the capital.

Scarcity: The Fuel of Desire

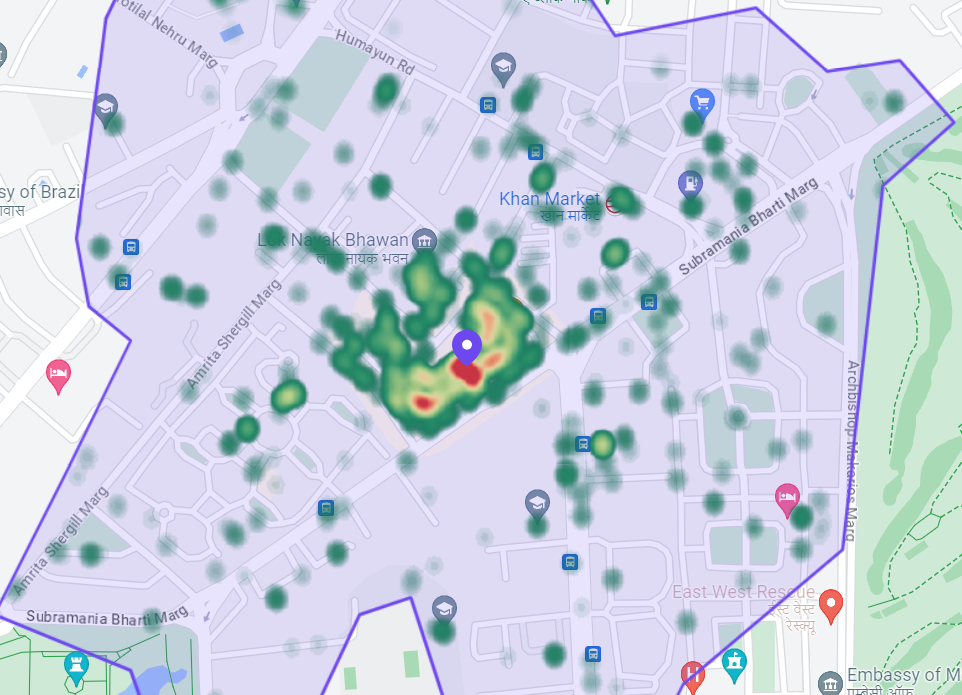

This is a footfall heat map of Khan Market. Notice the red color at the center of the pin indicating a high concentration of customers in that particular area.

Unlike the sprawling malls that mushroom across Delhi, space is a luxury at Khan Market. With only 60 storefronts, it’s a treasure box from an Arabian tale where only the best retailers can peddle their wares.

This scarcity fuels an insatiable desire, a Hunger Games-esque battle for a coveted spot. Landlords can command sky-high rents averaging $217 (₹18,000) per square foot, knowing that competition will always be fierce, a figure that pushes Khan market to the 22nd spot in the world’s most expensive high street locations.

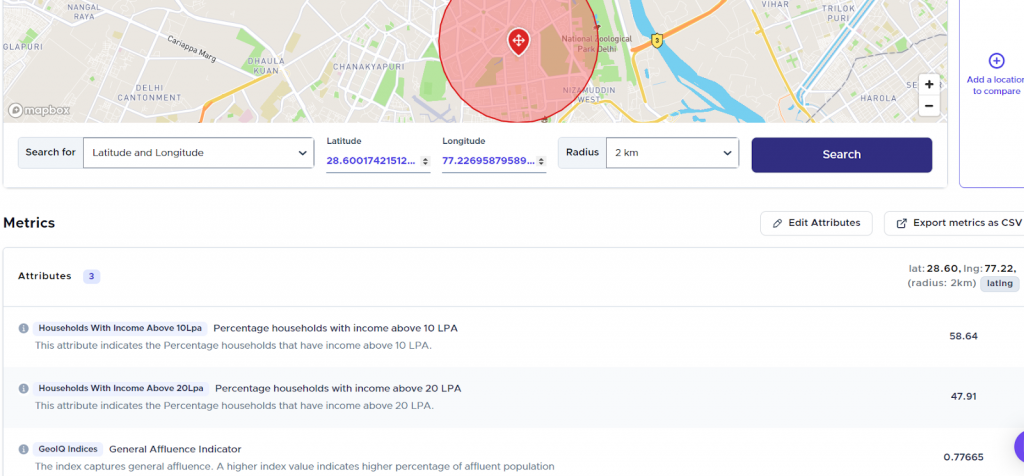

When factoring in the average income of the residents living in locations around Khan market, the sky-high rental rates charged by landowners become apparent.

We captured the above image from GeoIQ’s proprietary machine-learning engine. On the map, we dropped the pin at Khan Market and defined an area of 2KMs around the pin as the catchment area for this location. The numbers here show that 58% of the total population of this area earn more than ten lpa, with 48% earning more than 20 lpa. The average salary of Indians falls in the 2.8lpa range; this makes the slice of the population we have chosen place them in the 1% category of the Indian population.

The Shopping District of Delhi’s Elite

Khan Market caters to a discerning clientele, the Delhi elite, whose wallets are as deep as their fashion sense. These are the trendsetters, the tastemakers, the individuals who wouldn’t blink at paying a premium for exclusivity, personalized service, and the finest products money can buy. The catchment area for Khan Market is the elite neighborhoods surrounding the high street where over 23% of the population earns more than 20 lakhs per annum. This serves as an impetus for luxury brands to open stores next to their target audience. Brands like Torani and Vadham have opened their exclusive retail outlets in Khan market to cater to sophisticated customers willing to splurge on the correct product.

Accessibility

A study by the Delhi Urban Art Commission has identified that 36% of customers who visited Khan Market used their car while an additional 36% of customers get chauffeur driven to the market. The market is serviced by Rajesh Pilot Marg in the South, Humayun Road in the East, and Amrita Shergill Marg in the West, all major thoroughfares connecting the market to its immediate catchment area and beyond.

Times Square in New York City, Piccadilly Circus in London, and Champs-Élysées in Paris are prime examples of high streets succeeding due to the presence of a thoroughfare. Khan Market has the added advantage of being pedestrian friendly, where customers can explore its many labyrinth pathways and stumble upon bookstores dating back to the twilight years after independence.

The Delhi metro also serves the Khan market, drawing in customers from far beyond its catchment zone. As mentioned above, these can include tourists and curious shoppers who come to window browse through the shops that are part of the 22nd most expensive high street in the world.

Footfall and Changing Demographics

Khan market started with 154 shops and 75 flats, and in October 2023, the last of the flats was sold for a commercial retail project. What started as a regular market catering to the everyday needs of the residents of Lodhi Garden has morphed into a shopping destination for the rich and famous. This shift can be attributed to several factors, with accessibility and pedestrian-friendly streets playing a crucial role.

Khan Market is a well-designed and easily walkable market and reports suggest that a walkable street can increase retail sales between 20 and 40%.

The evolution of Khan Market from a local market to a global shopping destination is underscored by its accessible footpath design, influencing customers to discover new treasures through labyrinthine pathways. The influx of footfall and changing demographics highlight the market’s adaptive nature.

In essence, Khan Market’s ascendancy to India’s premium pin code results from a carefully orchestrated interplay of factors, creating a mix of location appeal, exclusivity, elite patronage, and accessible pathways.

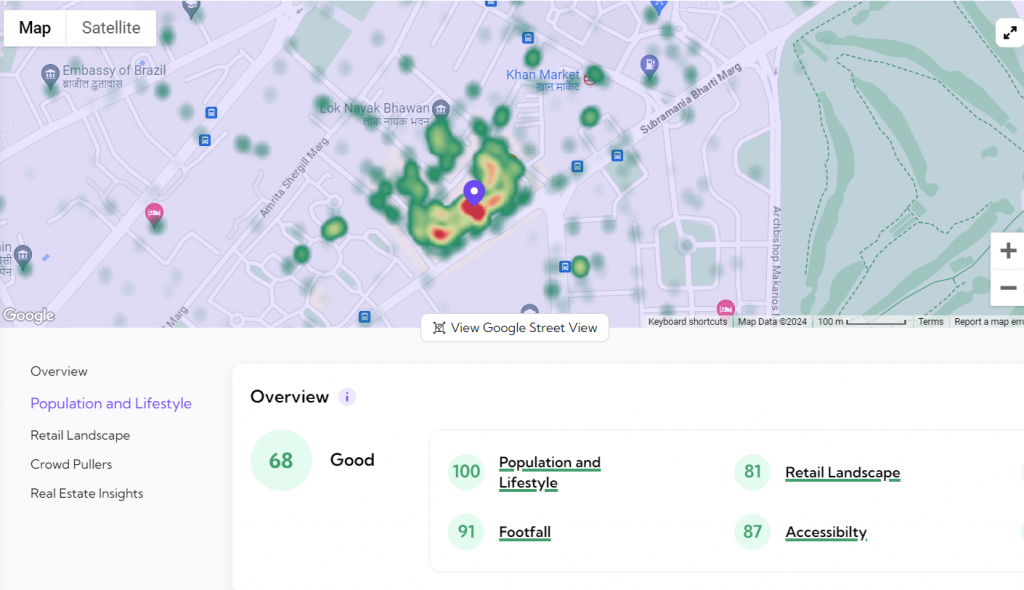

In the above footfall heat map, we have dropped a pin at the location of Khan Market. Notice the value of 91 associated with the footfall metric. This indicates that the location is at the 91% in terms of footfall in India. The image below details the presence of a pathway that pedestrians can use for every 1000 people.

Data Reveals the Difference Between Connaught Place and Khan Market

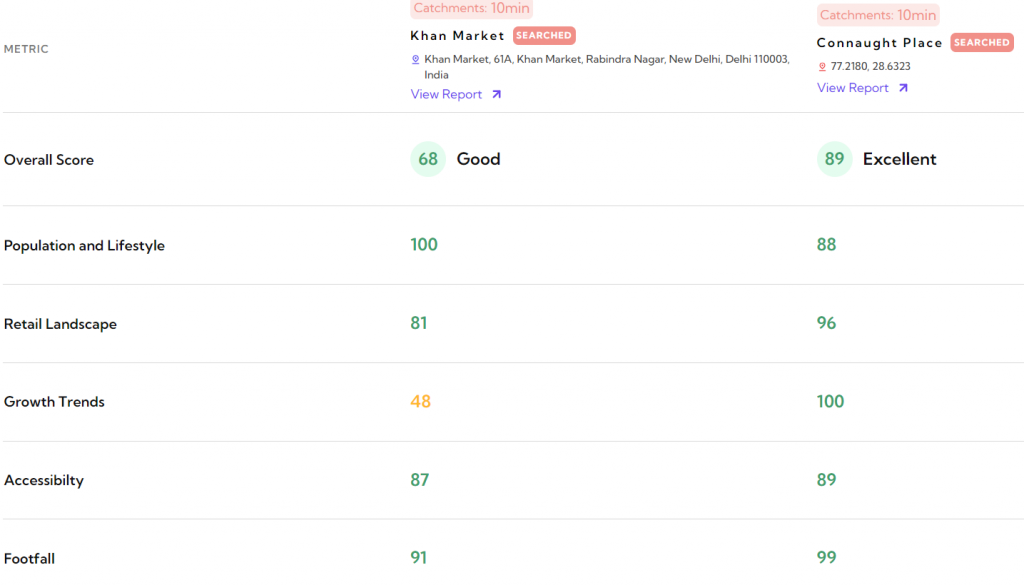

In the example, we have analyzed two high street locations in Delhi, Khan Market on the left and Connaught Place on the right. A glance at the number reveals a telling fact, that the growth trend in Khan Market is lower than Connaught Place.

Now, what does this number mean?

A lower growth trend simply corresponds to the number of new retail places popping up in the selected location. Alternatively, this attests to the stability of the location that retailers continue to renew their rental agreements. A positive trend in a location seeking to become one of the most expensive high streets in the world, wouldn’t you think?

After analyzing the attributes responsible for the success of a store in two regions of Delhi, Khan Market and Connaught Place, the RetailIQ model was able to identify the differences between these two places. But for a more granular understanding of their differences, consider the examples given below.

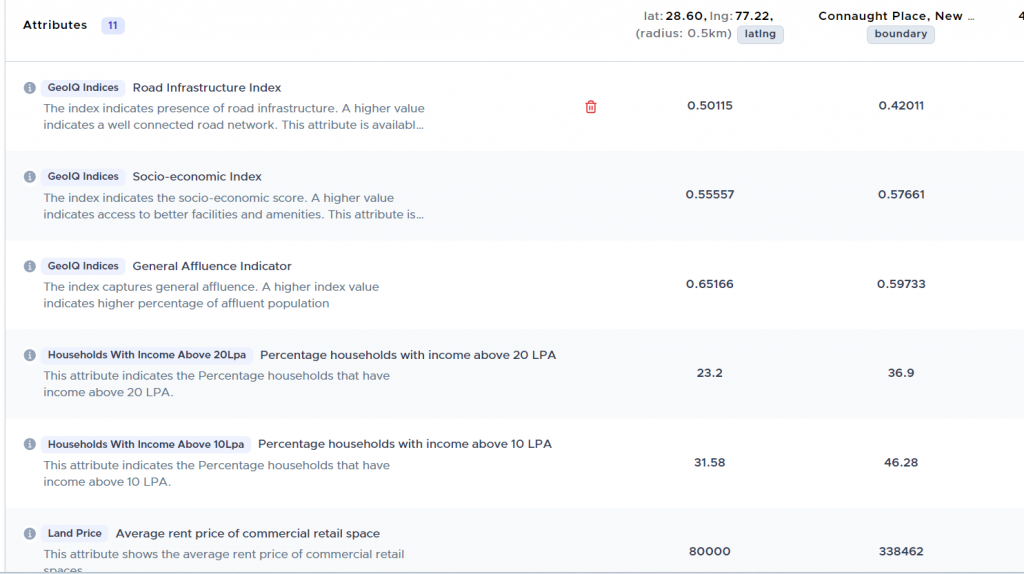

These variables and their associated metrics are derived from GeoIQ’s machine-learning model. Now what do these numbers mean?

The variables corresponding to the percentage of households earning above 10lpa and 20lpa indicate the affluence of the catchment area. For a high street to thrive, it must be surrounded by residential areas where high-networth individuals reside. Accessibility is one of the factors defining the success of a location. A better-connected location will enable customers from different parts of the city to reach the high street.

This image reveals key factors influencing customer spending in the selected area. Notably, a high concentration of cafes and restaurants signals strong purchasing power, as these are popular hangout spots for young, spend-conscious generations like GenZ and Millennials. Similarly, proximity to a train station, an indicator of easy access, further contributes to potential revenue growth for businesses here

These constitute just a fraction of the over 3,500 variables that empower our team in crafting comprehensive expansion profiles for retail brands throughout India. Our metrics play a pivotal role in minimizing the uncertainties faced by every business development leader in major retail chains across India when orchestrating business expansions. Take, for instance, the variable linked to the percentage of households earning above 20 lakhs per annum – this specific attribute provides invaluable insights for teams aiming to comprehend the economic landscape of a potential expansion region.

What Is RetailIQ

RetailIQ is a cutting-edge AI solution revolutionizing the retail sector by seamlessly integrating location data. It is a powerful tool for site recommendation and analysis, helping brands maximize revenue, minimize store closure risk, identify market potential, and refine target audiences down to street-level granularity. With custom models fine-tuned for individual brands and complementary brand analysis, RetailIQ surfaces tailored insights. Beyond recommendations, it offers comprehensive site analysis, giving retailers a competitive edge in profitable expansion and predictable growth through informed data-driven decisions.