Table of Contents

ToggleBrand Profile

Valued at over $78.50 billion in FY21, India’s jewelry market is the second largest in the world. The lion’s share of India’s appetite for jewelry is satisfied by the consumption of gold ornaments with Indians buying over 600 tonnes of gold jewelry in 2021.

Following a close second is India’s affinity with silver jewelry. The country is the largest market for silver jewelry in the world. Following the COVID-19 pandemic, Indians found themselves with a reduction in disposable income, turning a sizeable portion of the populace towards silver jewelry.

Keeping up with the changing times is the evolution of the fashion jewelry segment is set to generate over $2 billion in 2027.

However, the organised retail only accounts for 10% of this massive market.

The founders of the digitally native jewelry brand featured in this case study identified this market gap. They cater to an audience who aspires to own accessible and modern jewelry designs.

After the initial trailblazing years in the digital space, this DTC brand wanted to expand its retail presence into physical stores. Moving to an omnichannel set-up, the brand is looking to open physical stores targeting young demographics looking for trustworthy silver and gold jewelry with modern designs.

The Problem Statement

India’s retail market is still primarily unorganized with over 80% of retailers in the unorganised sector.

However, marquee retail brands occupy a large market share in the organized retail sector. Alongside their market dominance, these established legacy brands boast extensive data accumulated over years of operation.

For a young digitally native brand spreading its roots into the offline world, the lack of customer insights and data becomes a big challenge.

Data is crucial to unlocking a brand’s growth path by helping it identify the factors adding to its success.

-

- Profitable locations for the brand to open its next store

-

- Locations that avoid the risk of cannibalization

-

- Locations to maximise revenue and reduce the risk of store closure

Challenges

The brand identified the initial growth markets quickly, the obvious ones. The largest high streets and the biggest malls, draw in the brand’s target audience.

After exhausting its primary location options, the brand had to identify secondary markets. These could be the next set of high streets or malls, or they could be markets they haven’t considered yet.

The scale of the challenge becomes strikingly clear when contemplating the sheer number of markets of a city like Bangalore—over 600, to be precise.

-

- The brand had to identify the exact markets that would generate the highest ROIs

-

- Ensure that cannibalization from same-brand stores does not occur.

-

- Identify high-growth areas of the future.

The brand wanted to identify the location within a street with the most footfall and profitability.

Understanding Customer Defining Attributes

We segregated the areas with higher online orders per population vs areas where there were no or few orders. GeoIQ’s AI model identified the characteristics associated with higher-order density locations by mapping each of the 3500+ unique attributes to granular catchments. Next, the model looked for correlations between variables that behave consistently for varying order densities. This forms the basis for predicting the presence of the target audience at each location.

Moreover, the characteristics of the areas with higher order density helped us define the Target Group (TG) for the brand. The features of the TG are:

-

- High-rent apartment dwellers

- Residents of PGs and Co-living spaces with moderate to high rentals

- Tech-savvy early adopters

- Residents with high discretionary income

- Brand conscious

Mapping the TAM

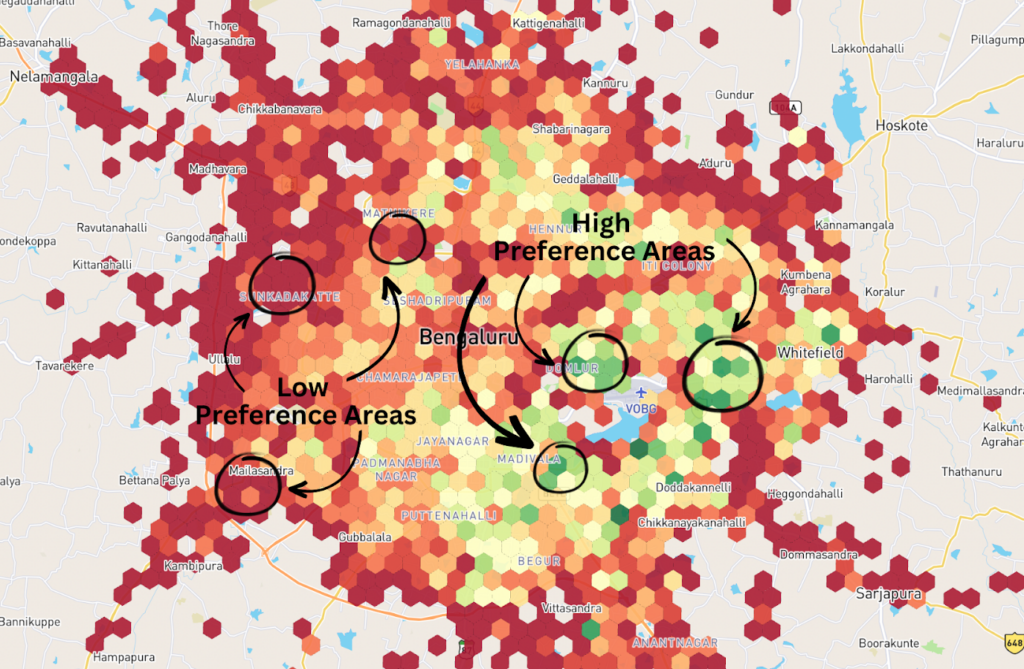

We identified the residential characteristics of the target audience and then began to identify catchment areas with look-alike traits across the city.

With the TG information, we were able to determine the total addressable market for the brand, which is the culmination of all the micro-catchments where the TG is present and demand is being generated

Based on the inferences derived from this exercise, we built a granular map of the city highlighting locations of high-density TAM and low TAM based on the demand and preferences.

An example of such a map would look similar to this:

Identify Markets catering to Prospective Customers

Furthermore, we identified that the order data was for residential properties. This would not be the location where the target audience shops, therefore, it became imperative for us to identify the shopping areas of the TG and we employed mobility data to determine the catchments the TG traveled to shop.

This allowed us to recommend locations where the TG visits/travels to as a profitable location for store expansion for the Jewelry brand

Impact

Visualising Success: GeoIQ’s machine learning unveils geo-patterns, empowering retail clients to:

-

- Slash underperforming stores by 50%

-

- Trim payback periods by 45%

-

- Accelerate finding profitable locations by 4x

Retail Insights

The availability of street-level performance data helps the jewelry chain remove the speculation associated with choosing a store location.

GeoIQ reduces the geographical area that the business development executives of the jewelry chains need to consider and physically scout before opening a store. Thus reducing the time required to open a store and further lowering the break-even time.

The data-backed solution provided by GeoIQ provided street-level granularity to the jewelry brand for its retail expansion.

Tailored-made Solutions for Retail Expansion: The model accurately forecasts the prospective revenue of a newly established store in the upcoming months.

The cumulative impact of strategically selecting optimal locations is substantial:

-

- Store-level revenue maximization contributes to an exponential boost in annual revenue

-

- Minimizes the losses incurred by flawed decisions

-

- Mitigates the risk of cannibalization from new stores.

What Is RetailIQ

RetailIQ is a cutting-edge AI solution revolutionizing the retail sector by seamlessly integrating location data. It is a powerful tool for site recommendation and analysis, helping brands maximize revenue, minimize store closure risk, identify market potential, and refine target audiences down to street-level granularity. With custom models fine-tuned for individual brands and complementary brand analysis, RetailIQ surfaces tailored insights. Beyond recommendations, it offers comprehensive site analysis, giving retailers a competitive edge in profitable expansion and predictable growth through informed data-driven decisions.