The importance of location in determining the success of a retail store cannot be underplayed.

The perfect retail location requires the smooth operation of multiple variables, but the failure of a store can sometimes be attributed to a single factor. To ensure that your next retail location is the perfect one, you will need to consider the parameters related to the success of a location.

In this article, let us seek to understand the six important tips to consider while choosing your store location.

Understanding Your Target Audience Before Choosing Your Store Location

In simple terms, it is the group of ideal customers who meet certain overarching parameters and share a common interest in purchasing products from the retail business. The presence of the target audience in a selected catchment area might indicate the success of that retail store contingent on other outside factors.

The factors that determine a target audience include, but are not limited to,

- Age

- Income

- Affluence

- Lifestyle factors

Let’s illustrate this with a simple example. Let’s consider the target audience for a jewelry retail store. This a new-age brand seeking to attract customers from the younger generation. To reflect this, the brand produces sleek, modern, and minimal designs. The average cost of their pieces is lower than the price of traditional jewelry, slotting them in a sweet spot of value for money and luxury.

Developing a customer persona for them helps us understand that their customers’ ages fall between 25 and 45 years. We also determined that their customers earn between 5LPA and 9LPA. We further identified that these customers possess at least a college education and are most likely married or in a relationship.

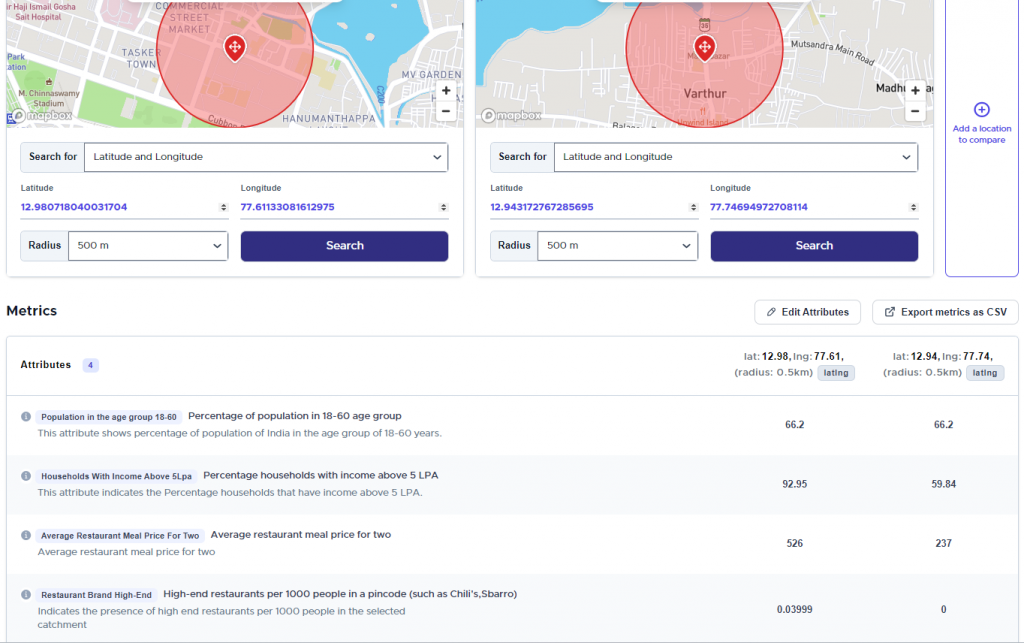

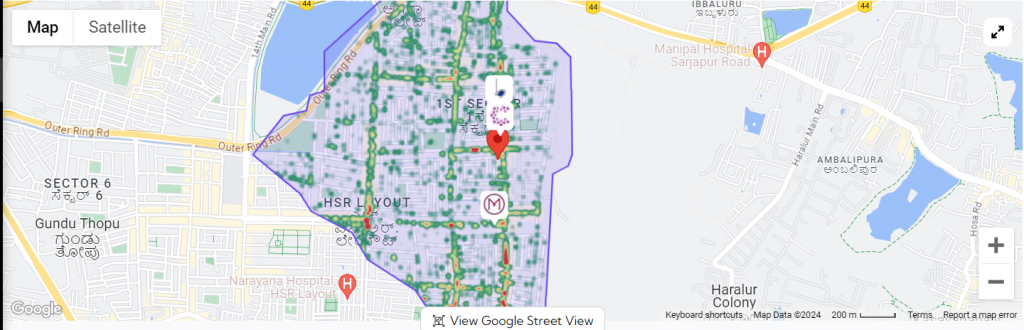

To better understand how a brand can identify its target audience based on retail analysis, we chose two locations, one a center of commerce and the other a residential area.

About the image

In this image, we have taken the example of two locations in Bangalore. On the left is Commercial Street, a fashionable shopping district frequented by the young and old. On the right is Varthur, a residential district in South-Eastern Bangalore

Notice that there is a sharp increase in the number of people earning more than 5LPA. Along with an increase in the average meal per two in a restaurant. The distance from the nearest high-end restaurant is also denoted in the image. The model highlights the absence of high-income restaurants in the 500-meter catchment around Varthur.

Suppose one of the factors identifying the presence of a target audience were these variables. In that case, we can realistically estimate that the target audience is only present near MG Road and not in Varthur.

Inferences from this data, after the application of business logic, help retail retail owners determine locations with the presence of their target audience.

Evaluating Foot Traffic Before Choosing Your Store Location

Even before retailers began to implement data analytics to steer their business decisions, retail store owners understood the importance of opening their shops next to high foot traffic areas.

Data analytics have offered retailers a more nuanced understanding of the success of a store relative to the foot traffic in that catchment area.

But what was the business intelligence behind opening stores on streets with high foot traffic?

There are a few reasons behind this decision.

- High-traffic locations tend to be packed with customers, either from the TG or otherwise.

- Humans tend to assign aspirational trust indicators to crowded locations. Opening a store on a busy street will subconsciously improve the credibility of the location in the eyes of the target audience.

- Locations with high foot traffic ensure that a retail store will attract a wide range of customers.

Furthermore, every high street has its unique retail DNA determining the composition of its customer base. For example, customers shop for electronics and computer parts at SJP Road in Bangalore. A retailer wishing to expand their electronics business can leverage the existing foot traffic to expand their business.

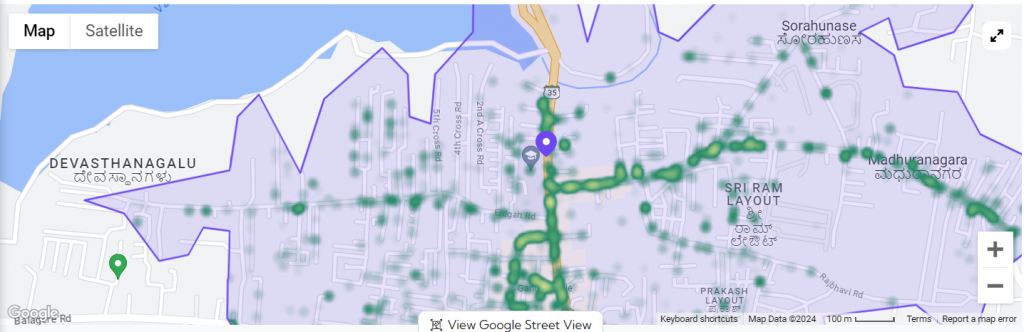

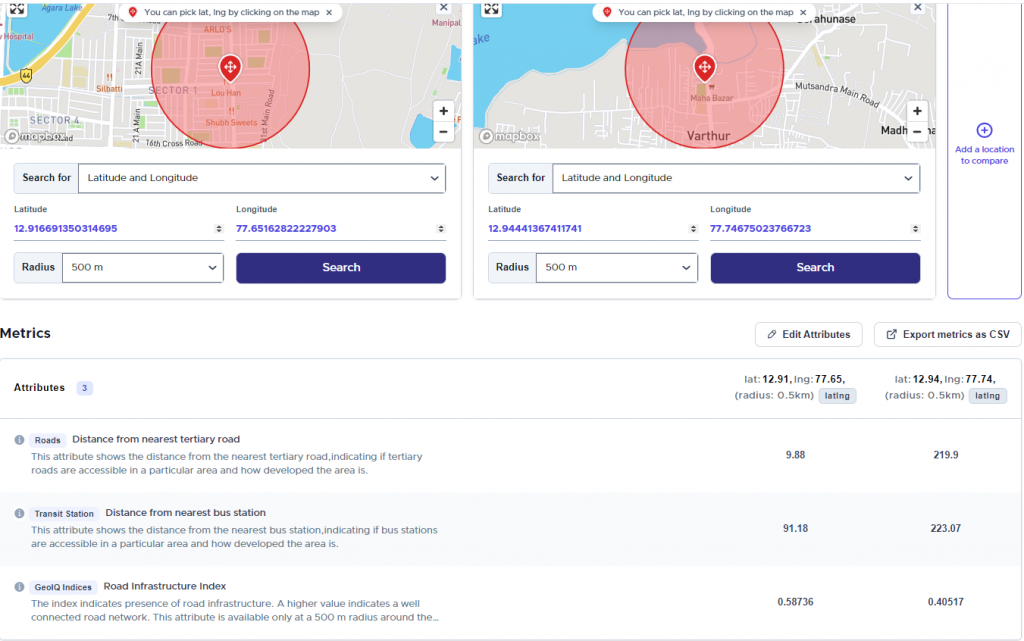

Example of Footfall Heatmap

The two images featured below are plots of footfall traffic at two locations.

The first image exemplifies the footfall traffic on Commercial Street in Bangalore. A shopping district with a large influx of customers. The red areas on the heatmap are the pockets with high footfall density on the specific street. The logic suggests that the new store for the hypothetical jewelry brand be placed closer to any of these pockets based on other factors.

The second image is the footfall traffic at Varthur, a location in South-Eastern Bangalore. The primarily residential area does not have dense footfall pockets highlighting the absence of a prominent marketplace.

Currently, GeoIQ is integrating a revolutionary concept of crowd puller into its AI model. A crowd puller is any location, a commercial establishment, or a public facility that serves as an anchor point to draw customers into the target catchment.

In the above example, notice the presence of crowd pullers in the pockets of high-traffic areas highlighting the importance of these establishments in drawing a large audience to the catchment.

Reasons to Leverage Competitor and Complementary Brands When Choosing a Retail Store Location

Nash Equilibrium is a famous solution in game theory defining the result between two or more competing players. This theorem is used as the basis for determining the clustering that occurs in retail.

For instance, in a competitive market, brands belonging to a similar category occupy locations adjacent to or close to each other. This is because the successful operation of a retail business in that location indicates the presence of a captive target market in that location.

The presence of complementary and competitor brands is indicative of the existence of the brands’s target audience in the selected catchment area.

This data is akin to a light getting turned on in the dark. Previously, a retail business could be considered as groping in the dark. However, with the identification of its target audience in the selected catchment area, the brand’s expansion strategy would lack the objective.

Analyzing the competition’s marketing strategies and a detailed investigation into the product merchandise mix will help retail stores build a winning strategy to boost their sales.

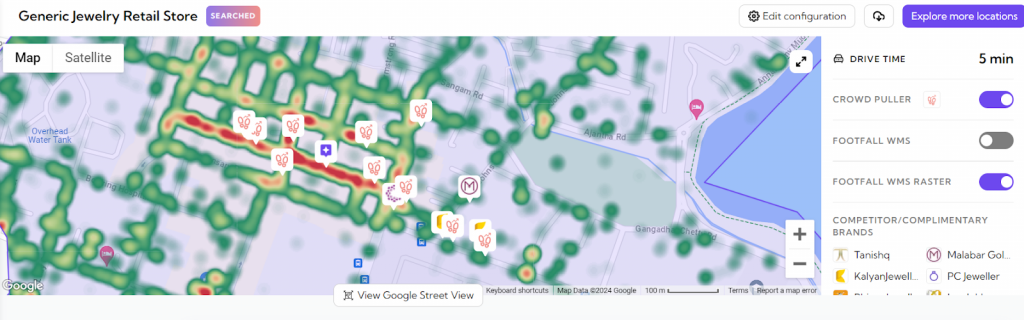

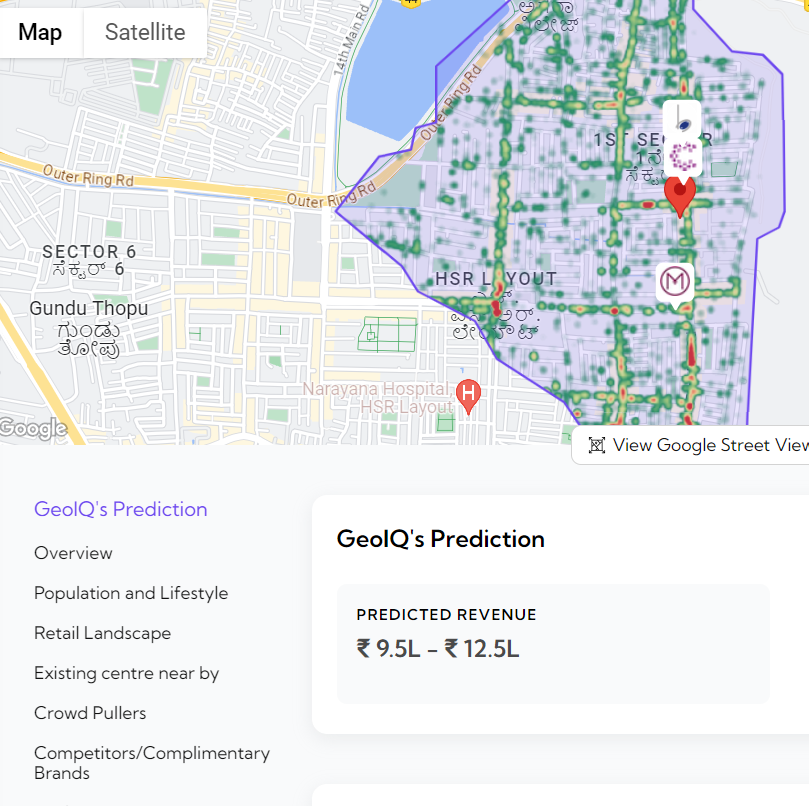

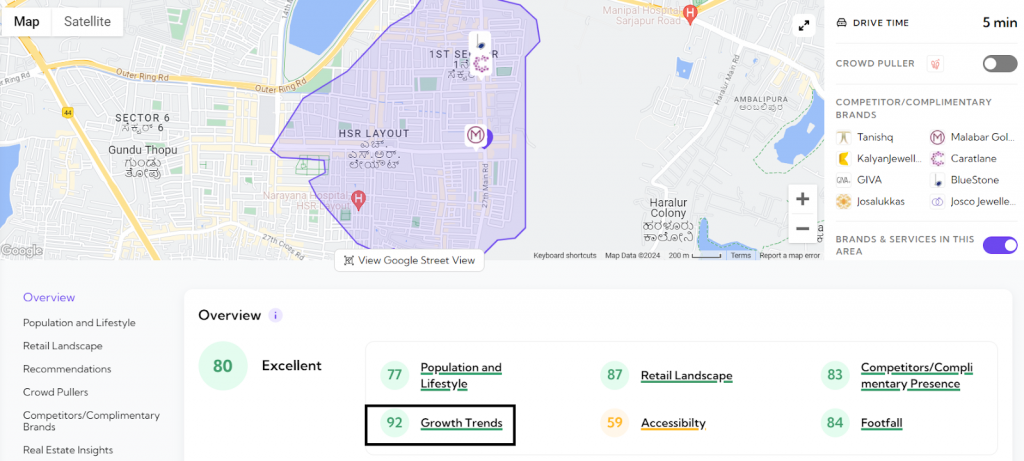

In this above example of the site analysis of a random fashion store located on the 27th Main Road of HSR, Bangalore, notice the clustered presence of the brand’s competitors.

This location analysis helps a retailer draw the following inferences,

- There is a large population density of the target audience in this location

- The foot traffic in the selected location is high enough to justify the development of a retail store

- An upward trend in the opening of new retail stores can be identified in the chosen location

What Is the Importance of Accessibility When Selecting a New Store Location

Opening a retail store is a moot point if it cannot draw customers. In an automobile-centric world, the ability to empower customers to use their vehicles for transportation plays a vital role in the success of a store.

The image above denotes a five-minute drive-time catchment area for a generic jewelry retail store. i.e., this catchment considers a drive time of five minutes in every direction from the store location.

Imagine if the customers who travel to the jewelry store could not park their vehicles next to the store. The customer will shift their business to another store. This is why most large brands have a dedicated team of valets who help customers park their vehicles, removing the hassle of finding a spot from their hands.

Importance of Roads in Accessibility

It is said that the road network was instrumental to the longevity of the Roman Empire. This holds for our current lives as well. Most people in India rely on road transportation to reach their destination.

This is why the connectivity to a robust road network is vital to the success of a retail store. Good road connectivity reduces the hassle for customers to arrive at the retail store and empowers smooth logistic operation. Placing a retail store on an interconnected road network helps reduce the time needed between a warehouse and the store.

How Transit Stops Aid in Improving Store Performance

Traffic logjams have become the norm in today’s urban agglomerations with high traffic density. This is increasingly pushing customers to choose alternative modes of transportation when accessing a retail store.

Customers can use multimodal transportation networks from metros to buses to reduce the time taken to reach their destinations. Retail owners who leverage the presence of transit stations to open their stores are reaping the benefits of accessibility.

Most of the high streets in Knight Franks’s report have more than one transportation network connecting to them. The inferences determined from this association are not difficult to miss.

Consider this example of an image generated by GeoIQ’s location model. The two locations considered here are MG Road, Bangalore, one of the country’s most expensive high streets, and the other is a random location in South-East Bangalore.

The value of the road infrastructure index that analyses the presence of transportation options in the two geographies tells a straightforward tale of its availability, with MG Road scoring high over the other location.

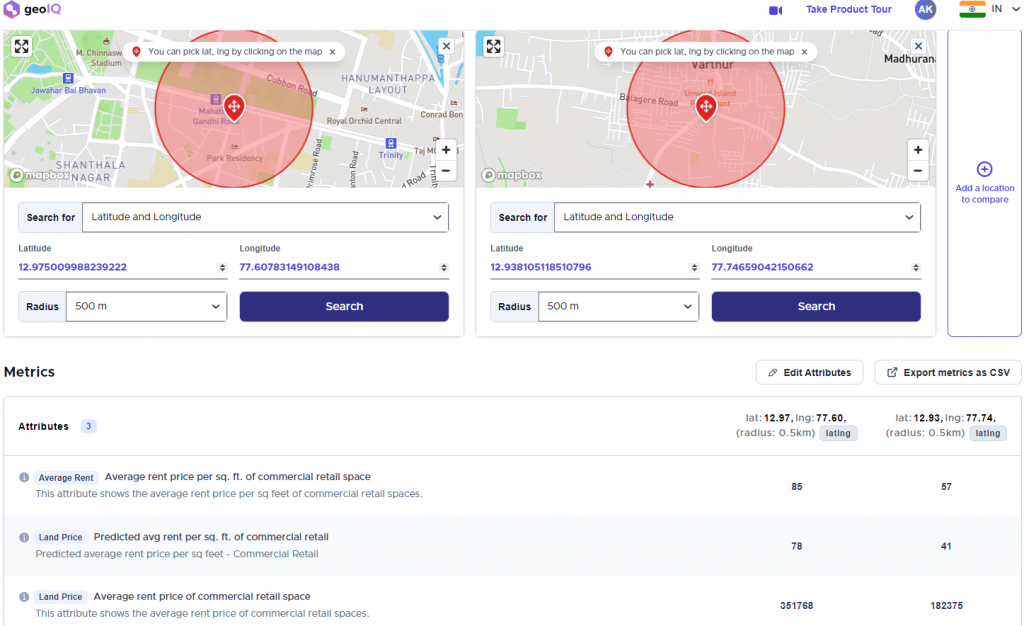

Financial Considerations Before Opening a Retail Store

Almost all retail stores have fixed costs and operational costs associated with opening a new store. They vary depending on the state and city where the store is spreading, with the variance occurring due to the site location.

From the expenditure incurred due to logistics to the rent of the property, these values result from the property’s location.

In the example below, we have chosen two locations—one on MG Road, Bangalore, and the other in southeastern Bangalore.

As expected, the high street commands a higher rental rate than the location in South-Eastern Bangalore. When a business expansion head rushes into building new stores without considering these factors, it can stymie its growth. Furthermore, the profit/ROI from a location is also dependent on the operating expenses at the site location.

For example, the electricity bill at a high street location will differ from one at a tier-3 city. But, there will also be a difference in the logistical cost between these two locations. The cost of hiring trained professionals to handle a business will invariably be higher in metropolitan areas than in a tier-3 city.

Prudent business leaders will predict revenue generation possibilities along with long-term strategic planning and develop a comprehensive expansion plan before renting out a location.

The return on investment in retail is a well-balanced equation factoring in both sides of the problem. The location of the retail store is crucial to the equation.

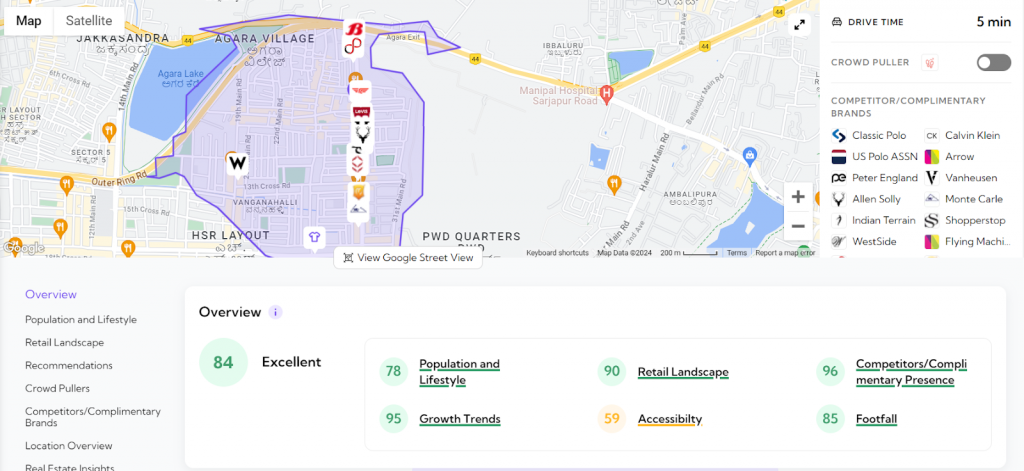

In this example below, the RetailIQ model accesses the factors determining a site’s revenue located on the 27th Main Road, HSR Layout, Bangalore. Business leaders can apply this inference to better understand the financial health of their future endeavors before investing in the location.

Importance of Location in Future Growth and Development

Developing a comprehensive and granular understanding of site location data helps businesses predict the real estate trends in a given location. For example, the image below contains the primary attributes responsible for the success of a generic jewelry store on 27th Main Road, HSR Layout, Bangalore. The RetailIQ platform determines the value of the highlighted section of the report, Growth Trends, based on the transformation of the retail landscape in the selected location. This includes the opening and closing of stores and the change in rental value.

Using this data, it is realistically possible to determine the trajectory of retail growth in the selected location.

Retail business leaders also use data to determine the probability of a new store in a tightly contested market. Data helps them understand if the market is saturated because of existing competition; in this case, the business leaders can investigate alternative locations to start their retail store.

Data helps retail businesses predict the development of a location into a business hub or the growth of a residential area. Leveraging this information empowers business leaders to select future-ready locations.

Conclusion

To Recap,

These are the six important tips to consider when choosing your store location.

- Understanding the Target Audience

- Evaluating the foot traffic

- Learning about the competitor and complementary brands

- Importance of accessibility

- Financial Considerations

- Location analytics in predicting the future development of the location

In summary, the key to successful retail expansion lies in meticulous consideration of the target audience, foot traffic, competitors, accessibility, financial aspects, and harnessing location analytics. By weaving these elements together, businesses can make informed decisions and pave the way for a flourishing and enduring presence in the retail landscape.