The latest FY2022 report of bad loans in India made significant news among economic experts. The issue of bad loans has been a cause of concern for the Indian economy for several years. According to the latest FY2022 report, India’s gross non-performing assets (GNPAs) have hit a six-year low of 5.9% as of March 2022. While this is a positive development, India still has the highest percentage of non-performing assets (NPAs) among comparable countries, according to a report by CareEdge. Barring Russia, all the comparable economies have less percentage of NPAs and all the developed countries have less than 3% NPAs in comparison to India. And, it all comes down to the poor addresses and address validation.

The graph indicates there is much improvement required to manage the defaulters to reduce NPAs under 3%. However, there has been an overall improvement in the reduction of NPAs in India and which is a great sign.

Often Financial institutions write off NPAs as part of their regular exercise to clean up their balance sheet, avail tax benefits and optimize capital. And, this write-off is carried out by the lending organizations in accordance with RBI guidelines and policy approved by the boards.

What Causes these Loan Collections to be a Big Hassle in the First Place?

Financial institutions face a significant challenge when borrowers change addresses without updating their information, complicating payment collection.

As a result, it causes higher turnaround time (TAT) in the loan collection process. And, it increases the operational costs for lending organizations.

Applicants with non-matching addresses often require additional documentation or manual verification, adding time and expense for lending organizations.

So, How can Lending Organizations make their Loan Collection Process more Effective with Address Validation?

The answer lies in loan origination itself.

The most complex problem of collection when the source address is wrong or incorrect can be solved by address validation at the loan origination only.

This can help financial institutions avoid the hassle of trying to track down borrowers who have moved or changed their addresses. Verifying borrower’s address during loan origination ensures accurate and up-to-date information for financial institutions and address verification software can actually help in this.

Benefits of Address Validation at the Source

There are several benefits of validating the address at the source, including:

- Improved accuracy: By address validation at the source, financial institutions can ensure that the address information provided by the borrower is accurate and up-to-date at the initial stage of the loan application itself. This can help prevent errors and discrepancies in the loan collection process, which can cause delays in the collection process and increase operational costs.

- Reduced costs: To ensure the operational costs associated with the loan collection are reduced and the turnaround time (TAT) of the process is decreased, it is vital to validate the address at the source. Ensuring accurate borrower addresses helps lending organizations avoid expenses associated with tracking down address changes.

- Optimizing efficiency: Every lending organization needs to streamline its collection process effectively, this is where validating the address at the source guides them to collection more efficiently. By having accurate and up-to-date address information, financial institutions can quickly locate borrowers and collect payments, without having to spend time and resources trying to locate them.

Effective Loan Collection Process via GeoIQ’s Address Quality API:

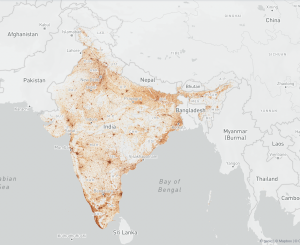

“The economic impact of bad addresses in India is significant: Emerging World’s estimate from the top industries indicate that poor addresses cost India $10-14B annually or ~0.5% of the GDP.”

This atrocious data indicates how inaccurate and wrong address plays a vital role in increasing the NPAs of lending organizations in the country. Often, lending organizations are unable to carry out the loan collection process seamlessly due to the given reason.

As a result, verifying source addresses at the time of loan origination is of utmost importance to lending organizations.

Borrowers do not always input their correct or complete addresses on digital loan application forms. Also, when manually collected, the address data is prone to human errors.

Conclusion: Leverage Address Validation for Better Efficiency

In conclusion, the issue of bad loans has been a significant challenge for the Indian economy, and reducing NPAs has become a top priority for lending organizations. One of the primary reasons for this challenge is the inability to track borrowers who move or change their addresses without updating their information with the lending organizations. The solution lies in validating the borrower’s address at the time of loan origination. This approach can help reduce operational costs, optimize efficiency, and improve accuracy in the loan collection process. By leveraging technology such as GeoIQ’s Address Quality API, lending organizations can effectively streamline their loan collection process, resulting in reduced NPAs and a stronger Indian economy.

Visit our website to know more about us.