Retail success isn’t just about choosing favorable retail locations; it also involves taking a step back to understand when a market is saturated and when it still holds potential. This article explores the importance of market saturation analysis and how it guides profitable retail expansion.

What is Market Saturation Analysis in Retail?

Market saturation occurs when the volume of a product or service in a given market has been maximised in its current state.

When too many similar stores exist in one area, new entries may face slower growth, cannibalisation, or even early closure. Understanding where your brand fits into the competitive density is key to minimising risk and maximising returns.

Why Market Saturation Analysis Matters in Retail Expansion

Avoiding Cannibalisation

When expanding, you risk stealing your own sales from nearby stores. A saturation analysis shows whether you’ll complement or compete with your existing locations. To avoid cannibalisation or over-expansion, the first step is to accurately estimate the total addressable market in a city. Next, you can logically assess the number of stores required to serve the addressable market.

Identifying Whitespace Opportunities

Markets that are underserved or have low competition are fertile ground for expansion. Saturation analysis helps identify these whitespace zones. It helps you identify high-demand areas where unmet opportunity lies.

Look for areas with fewer competitors but proven demand—those are your whitespace markets.

Reducing Store Closure Risk

Brands that skip saturation analysis often expand too fast into overly competitive areas. This leads to low profitability and potential shutdowns. If there are errors in estimating demand, total addressable market, whitespaces, and competition mapping, the chances of store closures increase drastically.

On the other hand, when you rely on external real-world data to correctly estimate the above factors and pick the right location to open your next set of stores, you can reduce the chances of store closure by over 50%.

Hyperlocal Marketing Strategy Based on Market Saturation

In a saturated market, visibility isn’t everything; relevance is. When entering a location dense with competitors, simply opening a store isn’t enough. You’re not just competing for footfall; you’re competing for attention, loyalty, and share of mind. This is where hyperlocal marketing becomes a key differentiator.

How to Conduct a Market Saturation Analysis

Step 1: Map Existing Stores

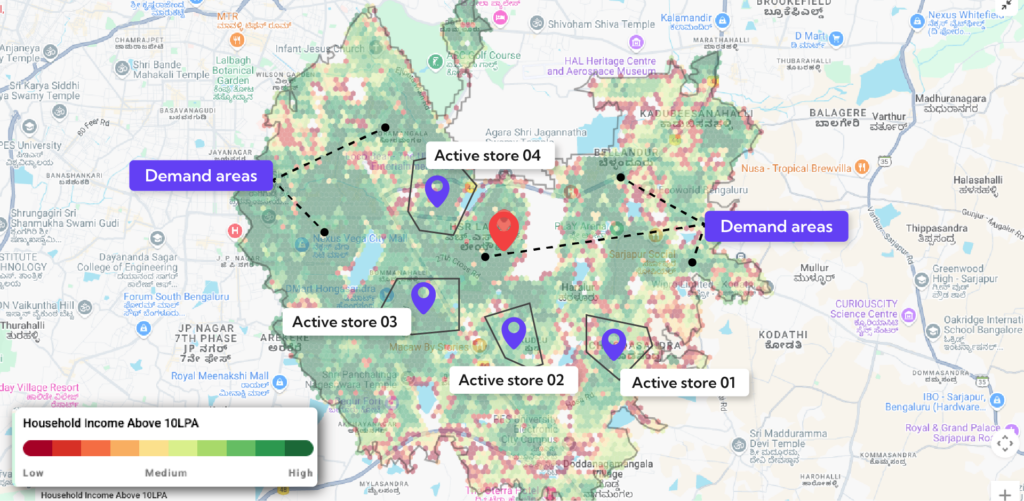

Plot your existing stores on a map. This will give you an overview of where your brand is present and which sector of the audience and locations it is already serving. By assessing their revenue potential and actual generated revenue, you can determine if they are underperforming.

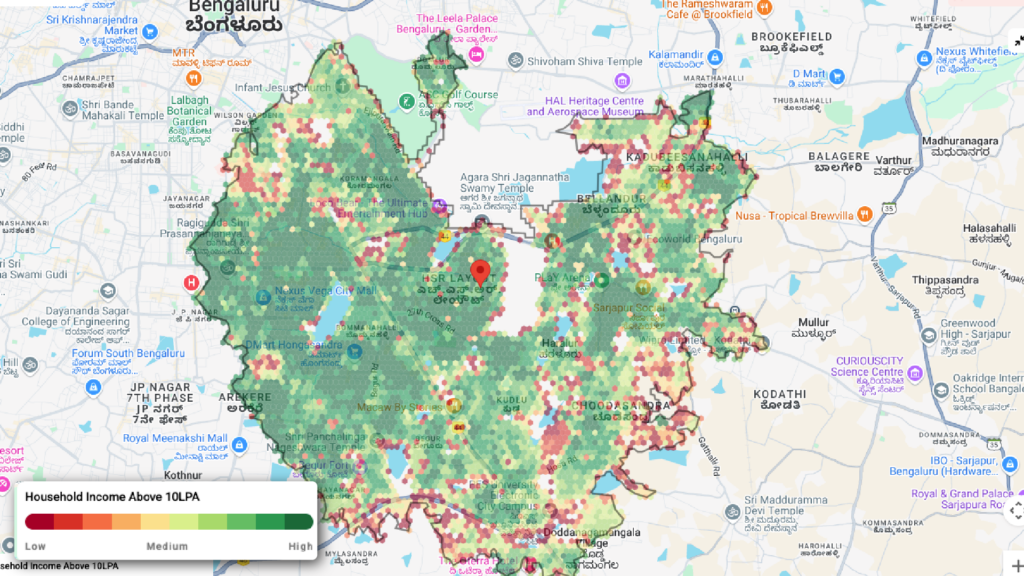

Step 2: Analyse Total Addressable Market and Predict Demand

Once you have mapped the existing stores, overlap that with the total addressable market. See if you are placed within or around high-demand areas, or serving underserved areas, or are failing due to the presence in saturated markets. With the analysis of the total addressable market, you will be able to understand where the opportunity lies for future stores.

Step 3: Benchmark Competition and Complementary Brands’ Presence

The presence of competition and how they perform at a location also helps you assess demand for the product category. It also enables you to assess if the market still has potential or is saturated. Moreover, the presence of complementary brands also indicates which markets are frequented by your target audience.

Step 4: Whitespace Analysis

Now that you have mapped the existing store network, assessed total addressable market and demand, benchmarked competing brands, and identified where complementary brands are present, finally perform a whitespace analysis. Identify regions with high demand, that are not saturated and have potential for your brand to thrive, and you do not have a store already to cannibalise sales in that region.

Step 5: Prioritise Markets

Once you shortlist the localities or markets to expand, you need to prioritise where to expand first and next. You can prioritise markets based on:

- Revenue prediction at each location

- Risk of cannibalisation from existing stores

- Risk of store closure at a location

- Catchment and trade area analysis

- Presence of competitors and complementary brands

- Understanding where shoppers come from to a specific market or location

Pro-Tips for Retail Brands

1. Don’t Just Look at Density, Look at Depth

Not all crowded markets are saturated. Dig deeper—use demand models, not just store counts, to evaluate whether the market can absorb another store without hurting margins.

2. Think Beyond Your Category

Look at complementary brands, not just competitors. Their presence can validate the area’s demand for your target demographic and guide cluster-based expansion strategies.

3. Use Real-World Data, Not Just Intuition

Go beyond demographic stats—layer in mobility patterns, footfall data, brand affinity indices, and spend behavior to understand true market potential.

4. Monitor Store Performance by Geography

The performance of your stores across cities and neighborhoods can reveal hidden saturation patterns. Poor-performing stores in an area may signal over-penetration.

5. Build a Saturation Scorecard

Standardise your decision-making. Create a scorecard that factors in store density, TAM, competition, demand potential, and footfall to rank each new market or micro-market objectively.

Conclusion: Saturation Isn’t a Stop Sign—It’s a Strategic Signal

Market saturation analysis is more than a tool—it’s a compass. It doesn’t just tell you where not to go; it points to where you should go next, how to enter, and what to expect. Brands that master this analysis aren’t just expanding—they’re expanding smartly.

In a time where footfall is fragmented, competition is fierce, and customer expectations are evolving, the difference between a successful and a failed retail expansion often lies in the depth of pre-entry analysis. By understanding saturation, spotting whitespace, and aligning strategy with hyperlocal realities, retail brands can make bold moves, confidently backed by data.