Neglecting competition in the market can lead to significant pitfalls. And, competition in the retail industry has evolved over the years.

Nowadays, the competition is not only the immediate store that opens next to you but also the changing consumer behaviour and buying patterns that fuel market shifts and take away your potential customers.

So, apart from analysing your nearby competitors, understanding your local market demographics, trends, and purchase behaviour becomes a necessity.

To tackle both at the same time and be successful in your retail journey, a cohesive competitor analysis is necessary.

Retail competitor analysis can be summarised into two:

- Location-based analysis

- Market position and strategy-based analysis

This article will show how you can effectively analyse competition at both these levels to ensure profitability and stay ahead of the competition.

What is competitor analysis?

Competitor analysis is a strategic process wherein a business systematically examines the strengths, weaknesses, strategies, and market positions of current and potential competitors.

This evaluation contains various facets – including competitor’s foot traffic analysis, catchment areas, target demographics, product offerings, pricing models, marketing tactics, and general operational efficiencies.

The primary objective of retail competition analysis is to gather actionable insights to tailor your offerings accordingly and have a sustainable business in the long run.

Why does competitor analysis matter in retail?

As we already know, the retail industry is very dynamic in nature due to many factors – shifting consumer preferences, technological advancements, and the continuous emergence of new market entrants.

In this context, competitor analysis serves several critical functions to help you stay afloat:

1. Identifying market gaps

i) By scrutinising competitors’ offerings, you can pinpoint unmet consumer needs or underserved market segments. You can then introduce a new or existing product to the market where demand for the same is unmet.

Utilising location intelligence platforms to break down various location metrics such as competitor presence, footfall, purchase behaviour, purchase power, etc will enable you to identify demand for a particular product more accurately at the SKU level.

ii) By breaking down competitors’ presence in the market, you could understand the demographics they target and the catchment area they serve.

Analysing this at the street level gives you an added advantage that you could capitalise on by extending your service to those underserved markets.

2. Enhancing customer experience

Understanding competitor’s service approaches and other in-store customer engagement activities helps refine your own servicing practices, ensuring a superior customer experience.

You could also find gaps in their existing customer service by visiting the store itself in a good old-fashioned way or you can also check their digital handles and GMB profile to understand their customer service.

3. Strategic pricing

Analysing competitors’ pricing structures enables you to position your products appropriately, balancing competitiveness with profitability.

Analysing competitor’s pricing structures helps you come up with a pricing strategy that works for the target demographic while keeping your profitability intact.

4. Driving innovation

Keeping yourself updated on your competitors’ technological adoptions and product innovations helps you with continuous improvement and differentiation.

For instance, if a competing restaurant deploys automation for ordering and billing, it’ll speed up the service process, which is extremely crucial if you’re located near universities or offices.

How to conduct retail competitor analysis?

Conducting a thorough retail competitor analysis involves a multifaceted approach, focusing on both location-based factors and broader market elements:

1. Location-based competitor analysis

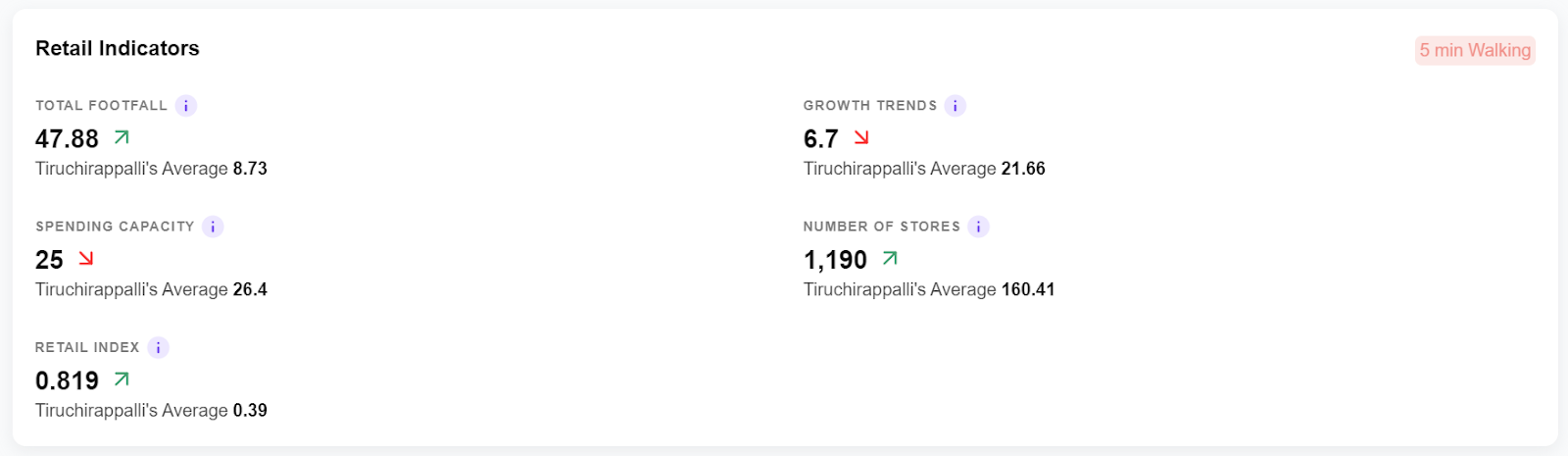

i) Foot traffic analysis

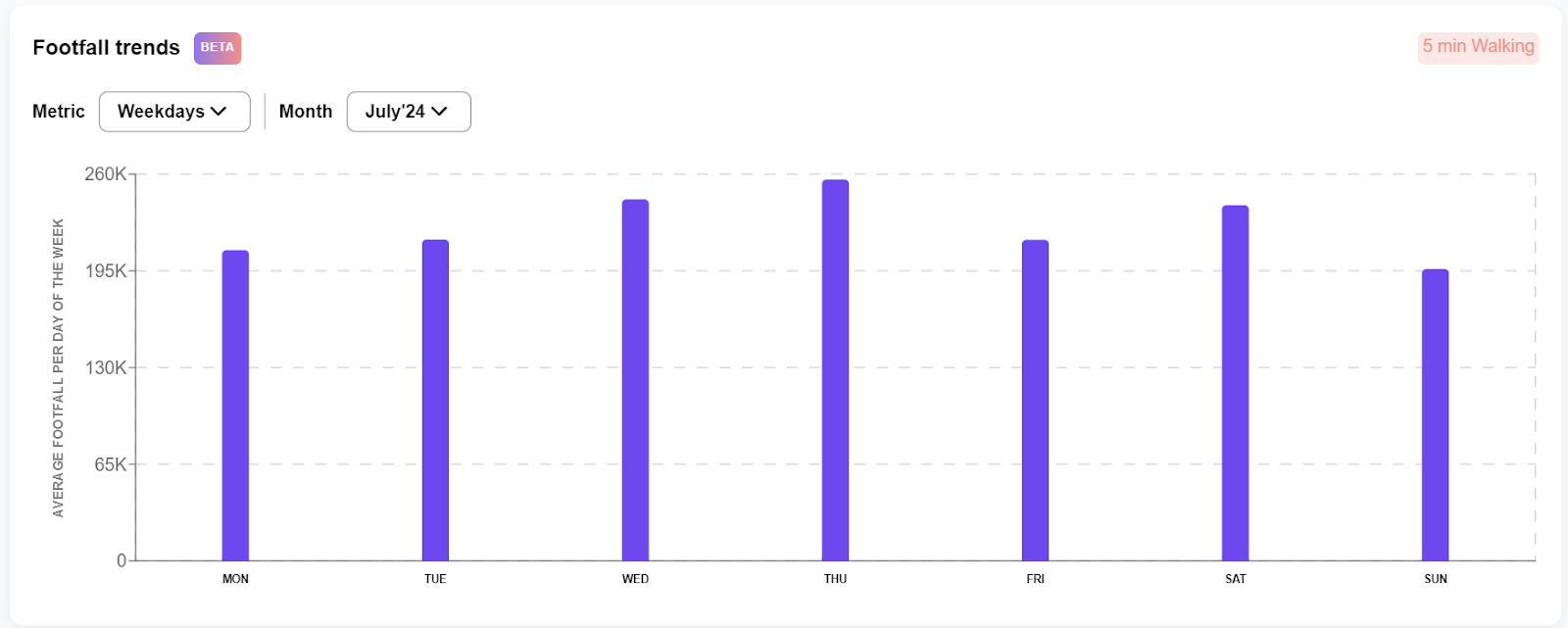

If you’re targeting a location it is vital to understand the overall foot traffic and the competitor’s foot traffic to understand their market share in the location.

Before the advent of AI and ML, retailers relied on manual observation, basic foot traffic counts, or anecdotal insights to assess competition.

One major example is Ray Kroc, who expanded McDonald’s. He and early franchisees would often visit potential locations and manually count passing cars and pedestrians to assess demand.

While it could work, there’s no way of knowing the exact number of foot traffic you get for a particular location you’re targeting.

With our location AI platform, you can get the exact number of foot traffic in your target location and the competitor’s like in the picture below:

Footfall trends of a location at 5 min walking time

Source: RetailIQ’s free site report

Assessing the volume and patterns of customer visits in a specific area provides valuable insights into how the business performs on a daily basis.

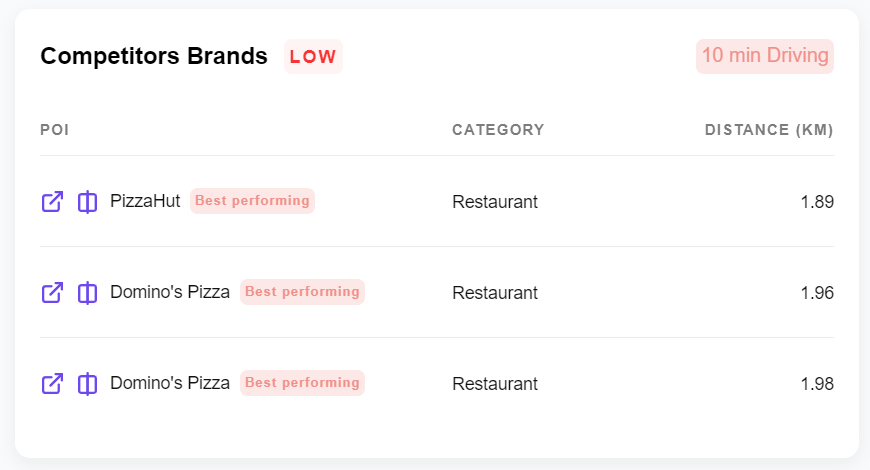

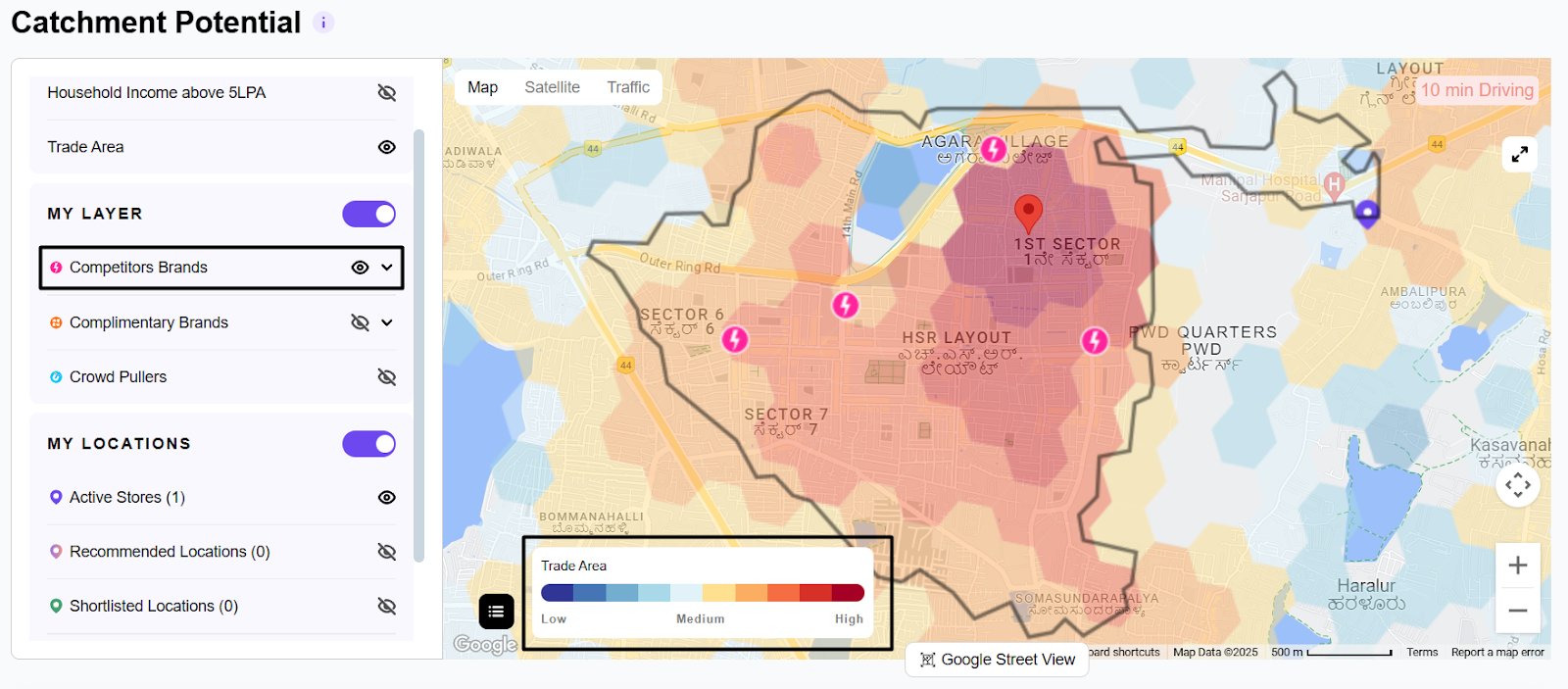

You can also gather existing competitor brands in the selected catchment area and how far the stores are from your target location.

Competitor brands in a location at 10 min driving time

ii) Catchment area assessment

Determining the geographic area from which a store attracts its customers is crucial.

Understanding where a competing brand’s customers and potentially your customers are highly concentrated and coming from lets you choose optimal locations to ensure you witness your desired sales.

Catchment potential of a location at 10 min driving time

Source: RetailIQ’s free site report

Also, analysing this catchment area helps you optimise marketing efforts, and inventory management, and identify potential areas for expansion.

For example, if you know where your customers are coming from you could run personalised marketing campaigns that resonate with them. Pairing this up geofencing marketing is another way to run campaigns that truly work.

iii) Demographic profiling

A location’s demographic data varies wildly from one street to another.

Analysing the age, income, lifestyle, and buying habits of local customers helps you customise your product offerings and marketing strategies to better compete in the area.

| Related: GeoIQ recommended product mix helped a brand see a surge of 45% more sales!

Demographic data of a location

2. Market position and strategy analysis

i) Product assortment evaluation

To identify any potential gaps in the market, you can compare the range and quality of products offered by the competitors. This can lead to finding opportunities for diversification or specialisation in the product you cater to.

ii) Pricing strategy analysis

Understanding competitors’ pricing models, including discounts, promotions, and loyalty programs, enables retailers to position their pricing competitively while maintaining healthy margins.

Understand competitor’s pricing models, including discounts, promotions, loyalty programs, etc.

This would help you position your pricing competitively while maintaining healthy profit margins.

iii) Promotional activities examination

Analysing the marketing campaigns, advertising channels, and promotional tactics of competitors delivers valuable insights into effective strategies and potential areas for differentiation.

As we mentioned earlier, you can utilise location data to your advantage to make the campaigns more effective.

iv) Customer feedback and sentiment analysis

Monitoring reviews, testimonials, and social media mentions related to competitors offers a window into customer satisfaction levels and areas where competitors may be underperforming.

This information is invaluable for refining your own customer service and product quality. This analysis also helps you strategise a guerilla marketing strategy if you wish to run aggressive marketing campaigns.

Tools and proven techniques for effective competitor analysis

Leveraging the right tool, like location intelligence can give you valuable data.

But for an effective, cohesive retail competitor analysis you should also be able to implement simple, proven frameworks to go one step further.

Below are some of the techniques you can utilise, explained briefly.

i) SWOT analysis

This framework helps in identifying the internal strengths and weaknesses of a business, as well as external opportunities and threats.

Applying SWOT analysis to both your company and your competitors provides a balanced perspective on competitive positioning.

Porter’s Five Forces analysis:

This model examines the competitive forces within an industry – such as the threat of new entrants, bargaining power of suppliers and buyers, threat of substitute products, and competitive rivalry – to assess the industry’s attractiveness and profitability.

For instance, using Porter’s five forces analysis, you can assess competitive pressure in a new market. If a coffee chain is considering opening a store in a high-footfall area, it can analyse:

- Threat of new entrants – How easy it is for a competing brand to enter the market?

- Competitive rivalry – How strong is the existing competition from established brands?

- Bargaining power of buyers – Do customers have many alternatives?

- Threat of substitutes – Could nearby bakeries or juice bars take market share?

- Bargaining power of suppliers – Are suppliers concentrated, affecting pricing?

Digital analytics tools:

It is important for any business to have a solid online presence.

To understand how competitors are doing in the online world, you could use multiple tools such as SEMrush, Ahrefs, Moz, etc to track competitors’ online performance, including website traffic, keyword rankings, and backlink profiles.

For social media monitoring, you can use tools such as Hootsuite and Brandwatch to track competitors’ social media activities, audience engagement, and public sentiment.

Conclusion

A thorough retail competitor analysis helps you position your brand in a market where it can thrive long-term.

It provides valuable insights into customer preferences, competitor strategies, and market opportunities, helping you make data-driven decisions.

Book a 15-minute discovery session with us to leverage location data and enhance your competitor analysis!