Technologies within the realm of Artificial Intelligence and Machine learning have been knocking on the door of many industries, and the retail sector isn’t left behind.

These tech advancements will be incremental in delivering exceptional shopping experiences to customers.

With the retail market size set to reach $2 trillion by 2023, we can safely say that the future of retail in India is looking vibrant despite the market’s dynamic nature.

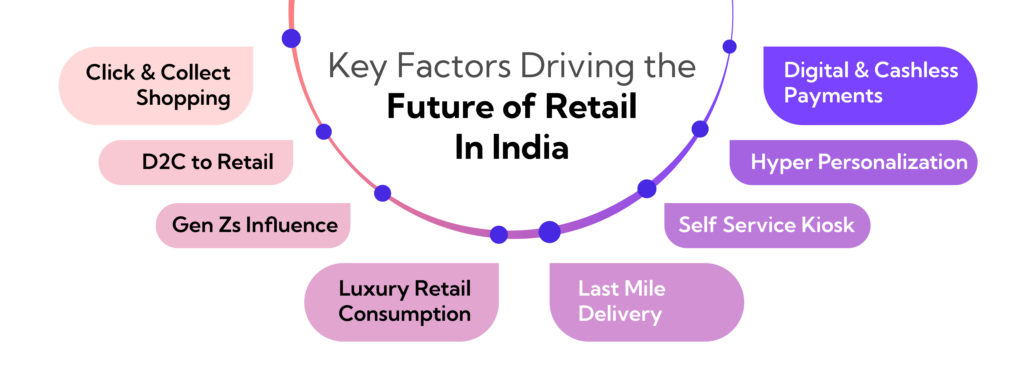

This might seem like a huge number, but it makes sense when we consider key factors such as,

- Increase in disposable income,

- Gen Z’s influence,

- Fusion of technology with retail.

These three will be the driving force shaping the future of the retail market in India.

Let’s dig a little into how the retail landscape has evolved over the years to understand what could potentially drive the growth of the Indian retail market in the future.

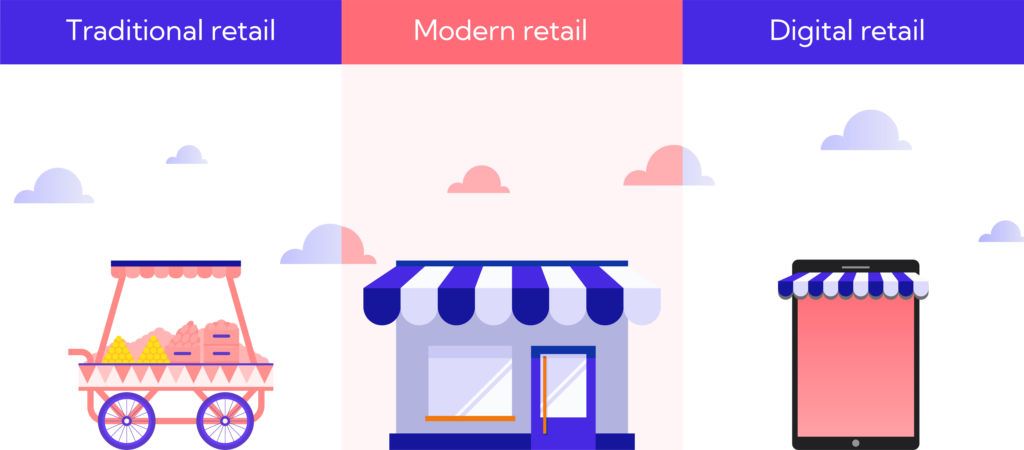

Stages of Retail Evolution in India

Retail evolution has gone through various stages, from the barter system to the present day.

To keep it relevant and short, if we look back 20 to 30 years, we can categorize retail evolution into three main stages:

- Traditional,

- Modern &

- Digital Retail.

Traditional Retail

These are generally the essential, small stores that we find around the corner. Owned by families and local people, these stores tend to offer essential goods from groceries, personal care products, and even some stationary items for kids.

In the ’90s, these were the only modes of purchasing any type of emerging products unless you traveled to big cities around your area. So, the exposure to foreign brands and even prominent brands in India like Bata, Titan, and Godrej was inaccessible for many.

Modern Retail

Modern retail encompasses established formats in the retail industry. This includes,

- Specialty stores,

- Departmental stores,

- Supermarkets,

- Multi-brand showrooms.

These stores made a wide range of products from local to international brands accessible to many people in urban and suburban areas. They offer everyday essentials to premium goods.

This resulted in a major penetration of modern retail formats in the market, with organized retail capturing approximately 8-10% of the total retail market in India by the early 2010s.

Digital Retail

The latest stage of retail evolution, digital retail, is marked by the rise of eCommerce and mobile commerce. As of 2023, although 40% of the population (690 million) in India has access to the Internet, the eCommerce penetration is still untapped.

But this gap is shrinking. Especially after COVID-19, we’re witnessing around 6 million new entrants to the digital space each month.

As we march forward into 2024 and beyond, the growing penetration of the internet, growing disposable income from the middle class, and advancements in technology are expected to significantly shape the Indian retail sector.

Future of Retail in India: What We Can Expect?

D2C Brands Entering Retail Market

The rising internet and eCommerce penetration led to a huge surge in people’s interest in D2C brands like Lenskart, BoAt, Arata, and others. With the increasing conviction for these brands, the D2C market is poised to reach $61.3 billion by FY27.

To capitalize on this growing demand, D2C brands like Lenskart, Nykaa, Snitch, and Licious have been entering the retail market. We can expect the same trend with other D2C brands.

The trickiest part is to find the ideal location for physical stores to ensure profitability and maximum ROI, minimizing the risk of store closure. This is where we come in.

At GeoIQ, we help retailers find the ideal location for opening or expanding their retail store with reliable data on predicted revenue range, footfall, catchment area, and much more.

Lenskart partnered with GeoIQ to identify ideal locations for opening over 900 profitable stores across India, achieving a 95% accuracy in revenue prediction.

Know More to Get Started!

Click and Collect Shopping

Click and collect shopping is an omnichannel delivery method that acts as a middle ground between online and offline shopping.

People tend to prefer offline over online shopping since they’ll miss out on the touch and feel of products that retail stores have to offer. This is highly likely specifically when it comes to fashion.

For the customer’s convenience, brands such as Shoppers Stop and IKEA have integrated this delivery method into tier-1 cities. Tata Cliq introduced “Cliq and Piq”, which is basically click and collect delivery feature for applicable products and locations.

It’s only a matter of time before eCommerce giants like Amazon and Flipkart jump on this bandwagon.

Digital & Cashless Payments

Though the number of entrants into the eCommerce space has increased, more than 70% of people still prefer Cash on Delivery (COD) for their orders.

On the other hand, UPI transactions hold 80% of the total digital transactions in India. To expand the online transaction space even further, the RBI has introduced eRupee (e₹-R), a tokenized digital version of the Indian Rupee.

In the coming years, we can expect this to gain traction and be widely used for transactions, including payments through QR codes.

If this trend continues, we’ll see a shift towards fully digital and cashless payments. This transition will add significant value to the future of retail stores in India.

Personalisation through Data Analytics

Retailers in India often miss out on personalizing the shopping experience for customers due to the sheer volume of the population. However, technological advancements have come here to solve this problem.

By analyzing customer data, retailers can now gain deep insights into consumer behavior, preferences, and purchasing patterns. This allows them to tailor their offerings and marketing strategies to individual customers, delivering a more engaging and relevant shopping experience.

Moreover, data analytics can improve Out-of-Home (OOH) advertising by making it more targeted and effective by utilizing location data. By pinning down areas with high foot traffic and affluence, retailers can optimize their OOH campaigns to reach their desired audience more efficiently.

Gen Z’s Influence

The future of retail in India will be heavily influenced by Gen Z consumers, a market of over a whopping 100 million as of now.

Globally, despite high internet penetration, over 65% of Gen Z still prefer shopping in brick-and-mortar stores. This preference is largely due to the ability to touch and feel products and the overall in-store experience.

This is a significant portion that still favors shopping in retail stores. Therefore, retailers need to stay on top of emerging trends to effectively appeal to these consumers.

Surge in Luxury Retail Consumption

People’s awareness of international luxury brands has been increasing steadily. As a result, the total luxury retail market in India is expected to grow at a CAGR of 1.34%.

Though the luxury retail market in India is relatively smaller compared to the West, it is expected to grow as Gen Z’s purchasing power and the number of affluent consumers increase over the years.

On the other hand, the market for pre-owned luxury brands is rising, making inroads into the middle-class segment.

Increase in Last Mile Delivery

The hyperlocal business model has gained huge traction in the last couple of years.

On-demand service platforms like Zepto, Blinkit, and more provide customers with quick and convenient access to a wide range of products, from groceries to household essentials. This trend will continue to shape the future of retail in India.

To capitalize on this trend, eCommerce giant Flipkart joined the bandwagon with its own last-mile delivery platform, “Flipkart Minutes.” We can expect many players from small to large corporations to enter into this space.

As more players enter this space, our location AI platform can help businesses identify optimal delivery zones with high-foot traffic and site selection for dark stores.

Self Service Kiosk

Almost every fast food chain like KFC, McDonalds, Burger King, and more has started implementing self-ordering kiosk machines at their restaurants in India.

Similarly, several small to mid-sized businesses like Wow!Momo, Box8, and Faasos have implemented self-ordering kiosks at select locations. As we move forward, these machines are likely to become more common in restaurants to ease up the self-checkout process.

Final Thoughts

As we mentioned before, increasing Gen Z’s influence, disposable income and technology will be the major factors in shaping the future of retail in India.

From these trends we’ve discussed, it’s clear that a proper infusion of technology with physical retail stores is more likely to happen in the next decade.

How Can We Help You?

GeoIQ is a data-driven location AI platform. We help retail brands in their expansion journey by finding the ideal locations for their new stores where they can maximize revenue and eliminate the risk of store closure.

We have a range of solutions suited for the sector such as revenue prediction, market footfall trends, identifying the total addressable market, trade area, shopper origins, and much more.

Reach out and let us help you finding you the best location for your retail store!