Avoiding both stockouts during peak demand and, conversely, warehouses overflowing with unsold merchandise is a major challenge for nearly all retailers nationwide.

These inventory misalignments directly impact the bottom line as the disappointed customers take their business elsewhere while excess inventory ties up capital & storage costs.

One way to mitigate these challenges is by understanding cycle stock and its role in maintaining a balanced inventory.

However, achieving this balance requires understanding the different components of inventory and accurately forecasting demand to develop an effective cycle stock strategy, which we will discuss in this article.

What is cycle stock?

Cycle stock, aka, working stock, denotes the portion of inventory a business depletes during normal operations between replenishments.

Cycle stock is the inventory you expect to use based on your demand forecasts – it’s the planned portion of your inventory that satisfies regular customer demand.

For example, if a grocery store sells approximately 100 litres of milk per week and receives weekly deliveries, its cycle stock for milk would be, as you guessed it right, around 100 litres.

This stock depletes gradually throughout the week until the next shipment arrives, replenishing inventory back to its starting level.

Cycle stock in retail is determined by two primary factors:

- The expected demand rate for products

- The replenishment frequency

When managed well, cycle stock follows a repeating pattern – it decreases steadily as items are sold and then restocks to full capacity when new shipments arrive.

Cycle stock vs. safety stock

One of the most common misconceptions in inventory management is confusing cycle stock with safety stock or failing to distinguish between these two critical inventory components.

While both are crucial, they serve different purposes.

Cycle stock is the inventory used to meet expected demand between replenishments. It follows a predictable pattern, depleting steadily and replenishing with each new shipment.

Safety stock, on the other hand, acts as a buffer to protect against unexpected demand spikes or supply chain disruptions. It prevents stockouts when actual demand exceeds forecasts or when deliveries are delayed.

For a better understanding, let’s use the same grocery store example.

If a grocery store sells 100 litres of milk per week and receives weekly deliveries, its cycle stock is 100 litres, as that’s the expected demand.

However, to avoid running out in case of unexpected demand surges or delayed deliveries, the store might keep an extra safety stock of 20 litres or however, is necessary depending on the location and its expected demand.

This proactive measure ensures the store can continue selling milk even if demand temporarily increases or a shipment arrives late.

Forecasting cycle stock with AI & external datasets

Traditional inventory forecasting methods rely heavily on historical sales data, which, while valuable, offer an incomplete picture.

Leading companies are now improving their cycle stock forecasting accuracy by incorporating external data sources that provide context and leading indicators for demand patterns.

Below are some of the major factors at play when it comes to forecasting demand for cycle stock:

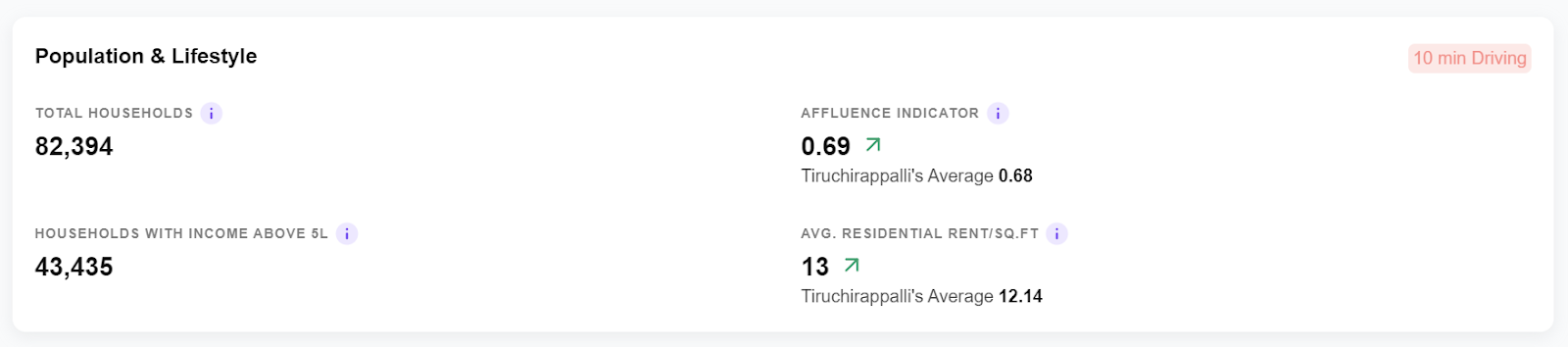

i) Local demographics

Understanding the demographic landscape of your market areas provides crucial insights for inventory planning.

Some key demographic factors include:

- Population density and growth trends

- Catchment area

- Age distribution

- Household income levels

- Affluence level

- Education levels

Understanding these factors & more helps predict purchasing behaviour and tailor inventory levels accordingly.

A higher population density or affluent neighbourhoods may indicate greater demand, while age distribution can influence product preferences.

For example, you may want to stock more premium products in high-income areas or adjust inventory based on the average age of local residents. Another instance is that a neighbourhood with many young families might warrant a higher cycle stock of children’s products.

So, analysing these demographics ensures cycle stock aligns with actual market demand, preventing stockouts or overstocking.

| Related: GeoIQ helped a brand limit its premium products at certain stores which resulted in 45% more sales!

ii) Customer preferences & trends

Consumer behaviour is constantly changing and influenced by various factors such as social media trends, influencer endorsements, and online search patterns.

These shifts become even more dynamic and complicated as trends change not just at a regional level but also at a street-level scale. So, analysing street-level data is essential to capturing these micro-trends and making precise inventory decisions.

To tackle this, utilising multiple datasets from e-commerce platforms, brand preferences, and Google/Meta searches, paired with other external data can help identify shifts in demand early.

Understanding shopping habits, including preferred product types on the SKU level and seasonal trends, enables better cycle stock planning.

For example, if a certain fashion is on trend on social media for a specific product, you may need to adjust your cycle stock to prevent stockouts and capitalise on the surge in interest.

iii) Competitive landscape

Competitor actions significantly impact demand for your products.

Understand where your competing stores are located and their catchment areas to assess how they influence customer footfall and market share.

Analysing competitor density, pricing strategies, and promotional activities can help you position your inventory effectively and avoid stockouts or overstocking.

This paired with, analysing competitor density, pricing strategies, and promotional activities can help you position your inventory effectively, anticipate demand shifts and avoid stockouts or overstocking.

For example, if a major competitor announces a promotion on a product category, you might need to adjust your cycle stock to account for potential decreased demand during that period.

Cycle stock calculation for retail

Now that you can simplify the demand forecasting methods, the next step is determining the right cycle stock levels to maintain optimal inventory.

The basic formula is:

Cycle Stock = Average Inventory − Safety Stock

Since cycle stock is directly influenced by demand patterns, accurately forecasting demand is key to maintaining the right inventory levels.

Most retailers may assume safety stock numbers based on gut feeling or anecdotal data. However, this can lead to inconsistent inventory levels, either causing stockouts or excessive holding costs.

As we mentioned earlier, here’s where the role of external datasets and AI & Ml becomes crucial for better inventory control.

Book a 15-minute call with us to learn how our advanced models can help you optimise cycle stock and inventory planning.

Benefits of forecasting cycle stock

Accurate cycle stock forecasting yields numerous benefits that directly impact the profitability and operational efficiency of your stores:

1. Reduced carrying costs

Carrying costs, including warehouse space, insurance, depreciation, and the opportunity cost of capital, typically range from 15% to 30% of inventory value annually. Precise cycle stock forecasting minimises these costs by reducing excess inventory.

2. Improved cash flow

Capital tied up in unnecessary inventory cannot be invested elsewhere. Optimal cycle stock levels free up cash for other business opportunities such as retail expansion.

3. Improved customer satisfaction

Maintaining appropriate cycle stock levels ensures product availability when customers want to make purchases. This in turn reduces stockouts and lost sales.

4. Optimised warehouse operations

Appropriate cycle stock levels streamline picking, packing, and shipping operations. A better process would be created with forecasting demand which improves labour efficiency and reduces operational costs.

5. Sustainable business practices

Precise inventory management reduces waste from obsolete products and minimises the environmental impact of producing, transporting, and storing excess inventory.

6. Better supplier relationships

Consistent, predictable ordering patterns based on accurate forecasts can lead to stronger supplier relationships and potentially better terms. This, in the long term, could translate to significant bottom-line improvements.

Conclusion

Effective cycle stock management in retail can give you a significant competitive advantage. And, modern cycle stock forecasting has evolved beyond simple historical projections.

For retailers, the message is clear: investing in cycle stock forecasting can be a strategic imperative that directly impacts the bottom lines of the business.

Book a discovery call to see how our models optimise cycle stock, cut costs, and improve inventory efficiency.