Valuing a commercial property is crucial for real estate investors, developers, and businesses.

However, valuing a commercial property does come with a set of challenges that need to be addressed properly with data to get the right valuation.

This article explores 5 ways to perform commercial property valuation and how data can be utilized for accurate valuation.

Major Challenges in Valuing a Commercial Property

Limited Access to Data: Historical sales data, market trends, and demographic insights are often incomplete, difficult to obtain, or worse, inaccurate.

Subjective Analysis: Valuation heavily relies on individual judgment, leading to inconsistencies and potential inaccuracies.

Time-Intensive Process: Gathering and analyzing data manually takes significant time.

Dynamic Market Conditions: Traditional methods struggle to adapt to rapidly changing market conditions such as sudden shifts in demand or economic fluctuations.

These challenges often resulted in valuations that were either overly conservative or unrealistically optimistic.

However, these challenges can be addressed by utilizing a location intelligence platform.

Location Intelligence Platform for Commercial Property Valuation

Location intelligence tools offer geospatial data and critical insights to assess property value more accurately, efficiently, and instantly.

Crucial Datasets that a Location Intelligence Platform Provides:

Demographic Analysis: Understand the population characteristics around the commercial property, including income levels, age groups, and spending patterns, to evaluate its market potential.

Foot Traffic Data: Analyze real-time and historical foot traffic patterns on an hourly, daily, and weekly basis to determine the property’s footfall trends.

Competitor Insights: Identify nearby competitors and assess their impact on your property value.

Rental Data: Get granular, street-level data on average rental rates in the area, helping you assess the commercial property’s potential rent and market position.

Advantages:

- Real-time data ensures up-to-date insights.

- Improved accuracy by combining 3000+ reliable and regulated data sources.

These crucial data from location intelligence platforms will aid in commercial property valuation by providing valuable context about a target location. Location intelligence platforms are not just useful for property valuation but are also invaluable for site selection, helping businesses of all sizes make better decisions.

5 Ways to Perform Commercial Property Valuation

1. Sales Comparison Method

The sales comparison method is one of the most straightforward and widely used approaches for property valuation.

It relies on the principle that the value of a property can be estimated by analyzing recent sales of similar properties within the same or a comparable location.

This method is best for residential and commercial properties in active markets with ample comparable sales data.

This method assumes that the market provides a reliable measure of value based on the prices buyers are willing to pay for similar properties.

Steps to Perform Sales Comparison Method:

Identify comparable properties: Select properties with similar characteristics such as size, location, amenities, age, and condition. These are typically referred to as “comps.”

Gather sales data: Collect information about the sale price, transaction date, and any conditions affecting the sale. This data is often obtained from real estate databases, brokers, or public records.

Adjust for differences: Account for variations between the property being valued and the comps, such as differences in size, location, upgrades, etc.

Estimate the value: Use the adjusted sales prices of comparable properties to arrive at a reasonable estimate of the property’s market value.

2. Income Capitalization Method

The income capitalization method focuses on valuing a property based on its income-generating potential.

This approach is particularly relevant for investment properties, as it emphasizes the financial return that the property can produce over time.

Key Steps to Perform Income Capitalization Method:

Calculate Net Operating Income (NOI): Determine the property’s annual income by subtracting operating expenses, such as maintenance, taxes, and property management fees, from the gross rental income.

Formula: NOI = Real Estate Revenue – Operational Expenses

Determine the Capitalization Rate (Cap Rate): The Cap Rate is the expected return on a property based on its current market value. It is usually calculated using market data or comparable property sales.

Formula: Capitalization Rate = Net Operating Income (NOI) / Current Market Value of the Property.

Estimate the property value: Divide the NOI by the Cap Rate to calculate the property’s estimated market value.

Formula: Property Value = Cap Rate / Net Operating Income (NOI)

This calculation is best for income-producing properties such as office buildings, retail centers, and rental apartments with stable and predictable revenue streams.

3. Discounted Cash Flow (DCF) Method

The discounted cash flow method assesses the present value of expected future cash flows.

Unlike the income capitalization method, which uses a single year’s NOI, the DCF method considers long-term income and expense projections. This makes this calculation ideal for investors seeking a detailed financial analysis of a commercial property.

Steps to Perform DCF Method:

Forecast future cash flows: Estimate the property’s expected income and expenses over a specific time frame, typically 5 to 10 years. While doing so, also take the overall growth trajectory of the local market into account.

Calculate net cash flows: For each year, subtract projected expenses from estimated income to determine the annual net cash flow.

Net Cash Flow = Total Income − Total Expenses

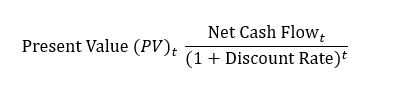

Discount to present value: To find out what future cash flows are worth today, we can apply a discount rate to each year’s cash flow.

To determine the discount rate for a property, you consider factors like the level of risk and the return investors expect. Higher risk usually means a higher discount rate, while lower risk means a lower discount rate.

This process doesn’t involve directly subtracting the discount rate. Instead, you adjust each future cash flow based on the discount rate and the number of years, converting the future cash flows to their present value, showing you how much they’re worth today.

Formula:

4. Cost Approach

The cost approach evaluates the value of a property based on the cost of constructing a similar property, adjusted for depreciation, and adding the value of the land.

This method operates on the premise that a buyer would not pay more for a property than the cost of building a new one with similar utility.

Steps to Calculate Commercial Property Using Cost Approach:

Determine construction costs: Estimate the current cost of constructing a similar building, considering materials, labor, and other expenses.

Account for depreciation: Subtract physical deterioration, functional obsolescence, and other depreciation factors that reduce the building’s value over time.

Add land value: Include the estimated market value of the land on which the property is located.

This calculation is best for specialized commercial properties, such as hospitals, schools, or factories, where comparable sales data may be scarce.

5. Residual Land Valuation

Residual land valuation is commonly used for development projects to determine the value of land based on its potential for redevelopment or new construction.

This approach is particularly useful for properties being considered for high-value developments such as residential complexes or commercial centers.

Steps to Perform Residual Land Valuation:

Estimate the completed project’s value: Determine the market value of the development upon completion – based on current market trends in the local market and comparable projects.

Subtract development costs: Deduct estimated expenses for construction, permits, marketing, and every other development-related activity.

Calculate the residual value: The remaining value represents the maximum amount a developer should pay for the land.

Conclusion

These are the 5 major methods for calculating a commercial property’s value.

Each method is important and suited to different property types. However, leveraging location intelligence tools like GeoIQ can simplify the process, helping you make informed, data-backed decisions with ease.