The beauty industry in India is transforming, with brands increasingly recognizing the importance of offline retail. While e-commerce and D2C platforms fueled their initial growth, the demand for experiential shopping, brand trust, and local presence has driven many beauty brands to establish physical stores. This report explores how D2C, luxury, and global beauty brands are carving their niche in the offline retail landscape, strategies, and the trends shaping their expansion.

While the D2C brands have been expanding to tier II and III cities across India, what’s interesting to note is that even luxury brands are coming forward to serve their affluent clientele in these cities.

Let’s explore this trend with some examples:

Apart from the metro and tier I regions of Delhi NCR, Bangalore, Mumbai, Chennai, and others, brands like Sephora, M.A.C Cosmetics, Forest Essentials, Nykaa Luxe, and others are opening stores in cities like Indore, Chandigarh, Lucknow, Bhopal, Mysore, and others. Below is a table of stores of these luxury brands in tier II cities mapped with affluence index around their store locations:

| Brand | Store Location | Affluence Index |

| Nykaa Luxe | Palladium Mall, Ahmedabad | .82 |

| Nykaa Luxe | Indra Nagar, Jaipur | .92 |

| Nykaa Luxe | City Centre Mall, Patna | .73 |

| Sephora | Elante Mall, Chandigarh | .64 |

| Sephora | Treasure Island Mall, Indore | .64 |

| Forest Essentials | Hyderali Road, Mysore | .64 |

| MAC Cosmetics | Gomti Nagar, Lucknow | .73 |

| MAC Cosmetics | Malviya Nagar, Jaipur | .91 |

| MAC Cosmetics | Lulu International Shopping Mall, Kochi | .67 |

Luxury beauty brands entering the Indian market within prime malls

We’ve seen some of the examples of luxury brands entering the emerging cities above. Additionally, many international luxury beauty brands continue to debut their presence in India with prime locations in metro and tier-I cities.

| Brand | Store Location | Affluence Index |

| Chanel | Phoenix Palladium, Chennai | .72 |

| Chanel | Select Citywalk, Delhi | .85 |

| Chanel | DLF Promenade, Delhi | .96 |

| Armani Beauty | DLF Promenade, Delhi | .96 |

| Ilem Japan | Phoenix Palladium, Chennai | .72 |

| Ilem Japan | Phoenix Mall of the Millenium, Pune | .79 |

Budget to mid-range D2C and e-commerce brands entering offline space

The rise of D2C saw many beauty brands emerge for the Indian consumer, finding their niche and achieving dramatic growth quickly. Moreover, for most of these brands, going offline was the next obvious step as the consumer experience that an omnichannel strategy can give cannot be replicated being purely online.

D2C brands are translating their online success into offline strategies by targeting high-traffic, cost-effective locations:

Example: Recode Studios operates exclusively on high streets with 19 stores across Tier-I and Tier-II cities like Mumbai, Nagpur, Raipur, and Ludhiana.

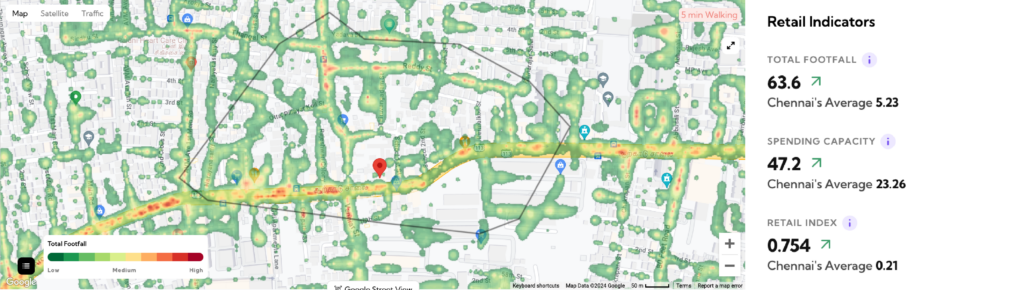

The image below signifies high footfall around the store location and the retail indicators around the Arcot Road region.

Fixderma, a dermaceutical brand that began online, is now establishing standalone stores in prominent high-street markets at premium locations; such as Gurugram’s Galleria Market.

The affluence index of this region is .97 and here’s a snapshot of “Retail Indicators” of the Galleria Market:

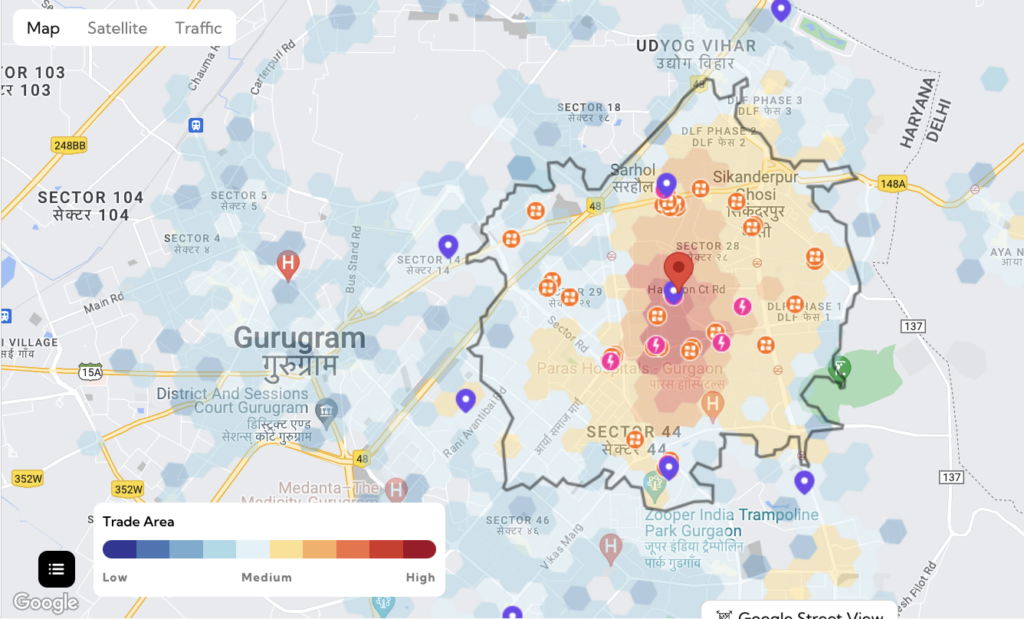

The Galleria market has become a destination market for the new affluent Gurugram population, making a range of luxury brands available. As a result, the Galleria market covers a large trade area, almost the whole of Gurugram, as in the below map:

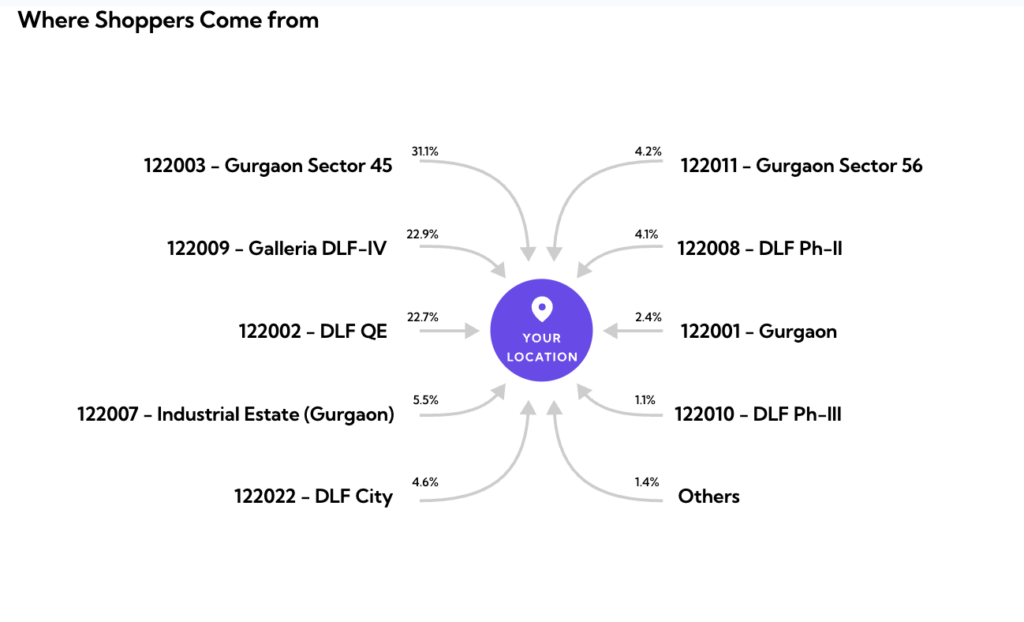

Let’s have a look at what percentage of people come from which region in Gurugram to shop at Galleria market:

Insights

- Tier-II cities are becoming key markets for expansion, offering a balance of cost and untapped demand.

- Metro cities dominate global brands’ entry strategies, with luxury malls providing the ideal setting for premium positioning.

- High streets are the preferred choice for D2C brands due to their affordability and accessibility.

Conclusion

The expansion of beauty and salon brands into offline retail reflects the evolving preferences of Indian consumers. Whether it’s luxury brands going beyond metro cities and targeting Tier II cities or D2C brands paving their niche into offline markets, the beauty retail category continues to grow. Many international brands are setting up stores in premium locations and malls in India strengthening the category’s presence in the retail sector.

Beauty brands can establish a strong foothold in this competitive market by:

- identifying the right markets to expand with location strategies

- dwelling deeper into consumer insights

- innovative retail formats